| The COVID-era public and private investment influx into Germany’s digital technology R&D is reversing amid inflation, fiscal consolidation, and geopolitical pressures coming from the Zeitenwende. |

| Germany’s future in an EU that is among the top-tier technology powers requires a profound and rapid transition of the country’s R&D strengths into data-intensive, systems-centric areas of IoT and deep technology that are linked to the domestic manufacturing base. New policy approaches in three areas – money, markets, and minds – are needed. |

| New technologies such as robotics, artificial intelligence (AI), advanced material science, biotech, and quantum computing tend to have broad general-purpose applications. But uncoordinated funding vehicles, universities’ civil clauses, and restrictive visa and onboarding guidelines for skilled foreign workers slow innovation in these sectors and hamper German techno-geopolitical competitiveness. |

| In the mid-term, Germany could look at a scheme to bundle the Future Fund together with new institutional investment in a sort of embryonic German Sovereign Wealth Fund, with a proportion of funding specifically geared toward strategically important VC endeavors. |

The web version of this report does not include footnotes. For source citation, please download the PDF version of the study here.

Introduction

Confidence in Germany’s technology ecosystem was, until recently, at an all-time high. By building on a robust research and development (R&D), investment, and startup base, the country’s digital sector was on course to displace manufacturing in terms of DAX-market capitalization by 2030. The benefits of this would have extended well beyond stock traders’ portfolios. A booming digital sector was to form a central plank of Germany’s future techno-geopolitical power: success would build the launch pad for German efforts to establish a European digital sovereignty based on “freedom-to-choose” technologies, enhanced resilience, and avoidance of technology dependencies that geopolitical rivals could exploit. The situation now is looking more tenuous.

Russia’s war, rising energy prices, and inflation are taking a toll on the worldwide availability of capital for the technology sector. Private investors are withdrawing from the German digital sector at an alarming rate. The German federal government is also turning toward fiscal consolidation with an eye on a balanced 2023 budget. At a time when Berlin is prioritizing defense modernization and renewable energy transformation, support for the country’s innovation industrial base could weaken dangerously if sufficient resources are withheld from the R&D behind digital technologies.

Germany has a highly differentiated economy fueled by cluster-based innovation, political federalism, a family-centric Mittelstand, and diffuse national research networks. This decentralized structure for innovation has, of course, historically been a strength. Highly developed niche capabilities proved globally competitive in the industrial era. But that era has largely ended. Today, at a time when network effects are key to international competitiveness in data-intensive platforms, AI, and cloud computing, Germany must better exploit its comparative advantages in the digital sector to address the three interconnected challenges of money, markets, and minds.

This is not just about Germany’s position in the world. Innovation is the key to global geostrategic ambitions. Ultimately, the trajectory of the German innovation ecosystem will define Europe’s evolving role as a great power in strategic technologies and as a champion for democratic technology governance.

The State of Play

Innovation requires an ecosystem comprising money, markets, and minds that is able to transition Germany’s R&D strengths into advantages in data-intensive, systems-centric areas of the Internet of Things (IoT) and deep technology that boost the domestic manufacturing sector. COVID-19 brought positive shifts in the structure of German and European innovation, especially in money. Indeed, across Europe, startup funding increased from approximately €40 billion in 2020 to €106 billion in 2021, creating an explosion of 321 European unicorns, venture capital-backed companies with a valuation of at least $1 billion. Germany alone had 55. It also had 26 decacorns, which were valued at more than $10 billion. Venture capital investment in Germany more than tripled between 2020 and 2021, reaching €17.4 billion in 2021. During this time, funding of deep technology, which includes robotics, AI, sensors, advanced material science, biotech, and quantum computing, also doubled in Europe and accounted for 21 percent of total venture capital raised in 2021. The money flow was so profound that it shifted frontier technologies to the areas of quantum and post-quantum cryptography, virtual reality health care, AI-based drug research, cognitive computing, and silicon photonics. Germany found itself particularly well positioned in robotics and sensor technologies due to the work of companies such as Q.ANT and Franka Emika, and the country is now developing capabilities in areas such as next-generation personal aircraft (at Lilium), biopharma (at BioNTech), and defense AI (at Helsing.ai).

Despite being a European technology innovator in certain sectors, Germany still lags behind competitors in other geographic regions. US and Chinese technology players may be market leaders, but those from the UK, Canada, South Korea, and Israel also race to capture, control, and commercialize innovation in areas ranging from social media platforms to deep technology. Even Europe’s largest technology company, ASML (market capitalization $352 billion), pales in size to Microsoft ($2.5 trillion) or China’s Tencent ($601 billion). Europe, in fact, has only 7 percent of the world’s technology market capitalization. And although it annually generates roughly the same number of startups as the United States, Europe has a higher startup stagnation rate (45 percent compared to 37 percent). That difference – partially attributed to easier access outside Europe to markets, late-stage capital, and talent – has led to a “scale-up” trap that has cost the EU approximately one million jobs and €2 trillion in GDP over the last two decades.

Germany also lags in financing. Its largest venture capital funds are small compared to those in the US and China. Its pension fund investment remains low, too. Meanwhile, 61 percent of all European late-stage investment that involves companies on the verge of market success includes at least one US investor, and 95 percent of all European late-stage funding exceeding $250 million involves an American or an Asian investor. US capital accounts for more than 50 percent of total investment in Germany and is particularly present in late-stage investment. Worryingly, this investment is drying up as European central banks respond to inflation, and geopolitical risk arising from Russia’s invasion of Ukraine decreases global institutional investors’ willingness to fund the digital sector.

• Bavaria’s consortium-based quantum initiative binds the research networks of the Fraunhofer Society, the Max Planck Society, and the Technical University of Munich (TUM) into a Center for Quantum Computing and Quantum Technologies (ZQQ). The Center is at the heart of a Munich-based techno logy park that also includes private sector players such as IBM, whose Q System One is used in Ehningen. While Q System One operates with 27 qubits, IBM aims to finalize its 1000+ qubit-chip as soon as 2023.

• Cyber Valley is Europe’s largest AI research cluster. It brings together the Max Planck Institute for Intelligent Systems, the University of Tübingen, and the University of Stuttgart with private sector actors such as Daimler, Bosch, Amazon, and BMW. Cyber Valley is developing a €180 million campus in Tübingen.

• The Jülich Research Center’s collaboration with Canadian company D-Wave led to Europe’s first 5000-qubit quantum computer. The ultimate aim is a moonshot integration of the device into Jülich’s supercomputing infrastructure, which is set to go online in mid-2024. The Federal Ministry of Education and Research has allocated €76.3 million to Jülich’s QSolid collaborative project, in which 25 companies and research institutions – including the Leibniz Institute of Photonic Technology, the Karlsruhe Institute of Technology, Ulm University, the Free University of Berlin, and the University of Cologne – are joining forces to build a complete quantum computer based on cutting-edge technology.

• The German Research Center for Artificial Intelligence (DFKI) is one of the world’s oldest and largest AI research bodies. It has facilities in seven cities that work in fields including image recognition, simultaneous translation, robotics, and cognitive assistants.

Germany’s embryonic technology champions are consequently compelled to seek non-European funding as they grow from startup to mature market player. They are also compelled to face an uncomfortable paradox: the greater their success, the greater the stake held by American and Chinese venture capital and institutional investors. At the same time, German and European finance pursues only a limited “going out” foreign and direct investment (FDI) strategy to seek opportunities in regions beyond national or EU territory. Lack of capital, fear of risk, regulatory differences, and domestic dependencies all hamper going further afield. European venture capital flowing into the US is much less than that which is flowing the other way. The result is that Europe is largely absent from global technology investment. It is often on the sidelines in the competition for innovation.

An additional disadvantage Germany faces is its limited ability to draw on talent outside Europe, which puts it behind in the global competition for the best minds. Europeans comprise an overwhelming 85.9 percent of German start-up workers, while only 6.6 percent hail from Asia, 2.2 percent from North America, and 5.4 percent from elsewhere. In contrast, two thirds of Silicon Valley workers in engineering and computer science were born outside the United States. Moreover, 52 percent of US unicorns have at least one founder born outside the country. In Germany, one in five founders has a migration background, and a mere 15 percent of German founders are women. Equally striking, only 1.3 percent of European funding went to founders belonging to ethnic minorities.

It is true that Germany’s technical research system has matured in recent years, facilitated by liberalized university admissions policies for international STEM (science, technology, engineering, and mathematics) students and a strong economy. Here, Germany has been helped by geopolitical tailwinds: developments that have pushed IT talent out of southern eurozone countries, the Middle East, and, most recently, war-torn Ukraine and authoritarian Russia. But Germany still lacks the flexible labor conditions, salaries, benefits, and research resources to attract and retain top talent. The United States, Canada, and the United Kingdom are still winning that race at a time of a global IT labor shortage.

The information and communications technology (ICT) talent gap is a key hindrance for Germany’s global technology position and, ultimately, for European security. The EU has set a target of having 20 million ICT specialists by 2030, but Germany is producing just 70,000 of them annually. Silicon Saxony has a worker gap of almost 30,000 in its semiconductor sector. Saxony-Anhalt, the site of Germany’s future semiconductor production base, faces an even more acute struggle of attracting European and global talent from areas like South and East Asia, the Middle East, and Africa. In both German regions, political and social environments that, in some instances, tolerate right-wing extremism, racism, and xenophobia, add to the challenges. Insufficient staffing at Germany’s cyber agencies, such as the Federal Office for Information Security (BSI), the Cyber Innovation Hub of the German Armed Forces, and the recently established Cyber Agency in Halle, remains another top strategic constraint, and one that may lead to difficult choices when setting and pursuing priorities.

Some of the most dynamic innovation ecosystems in digital technology have developed in small, open economies facing a persistent security threat from a geopolitical rival. That existential threat can create a sense of national mission that facilitates an interdisciplinary approach to state-supported R&D and overcomes the challenges of a small domestic market. This is the case in Taiwan, Estonia, South Korea, and Israel, all of which have developed globally competitive technology innovation ecosystems, often closely linked to their defense sector. As a middle power that lacks a sense of imminent geostrategic danger, Germany relies on the EU market to bolster its ambition to be a hub for innovation. But the limits of EU regulatory convergence have become more evident, and Germany should shift its market-building strategy toward using open standards and open source software as a means to lower barriers for digital technology R&D on the supply side. Greater economies of scale can also help to counterbalance the strengths of Germany’s technology competitors in areas such as market size (US, China) or mission-driven cohesion (Israel, Taiwan, South Korea).

The Current Policy Approach

German innovation policy is most intensely focused on basic R&D. The country already allocates 3.13 percent of GDP for spending on it, and the Ampel government has set an ambitious goal of increasing that to 3.5 percent. Current German spending accounts for 31 percent of total European R&D expenditure.

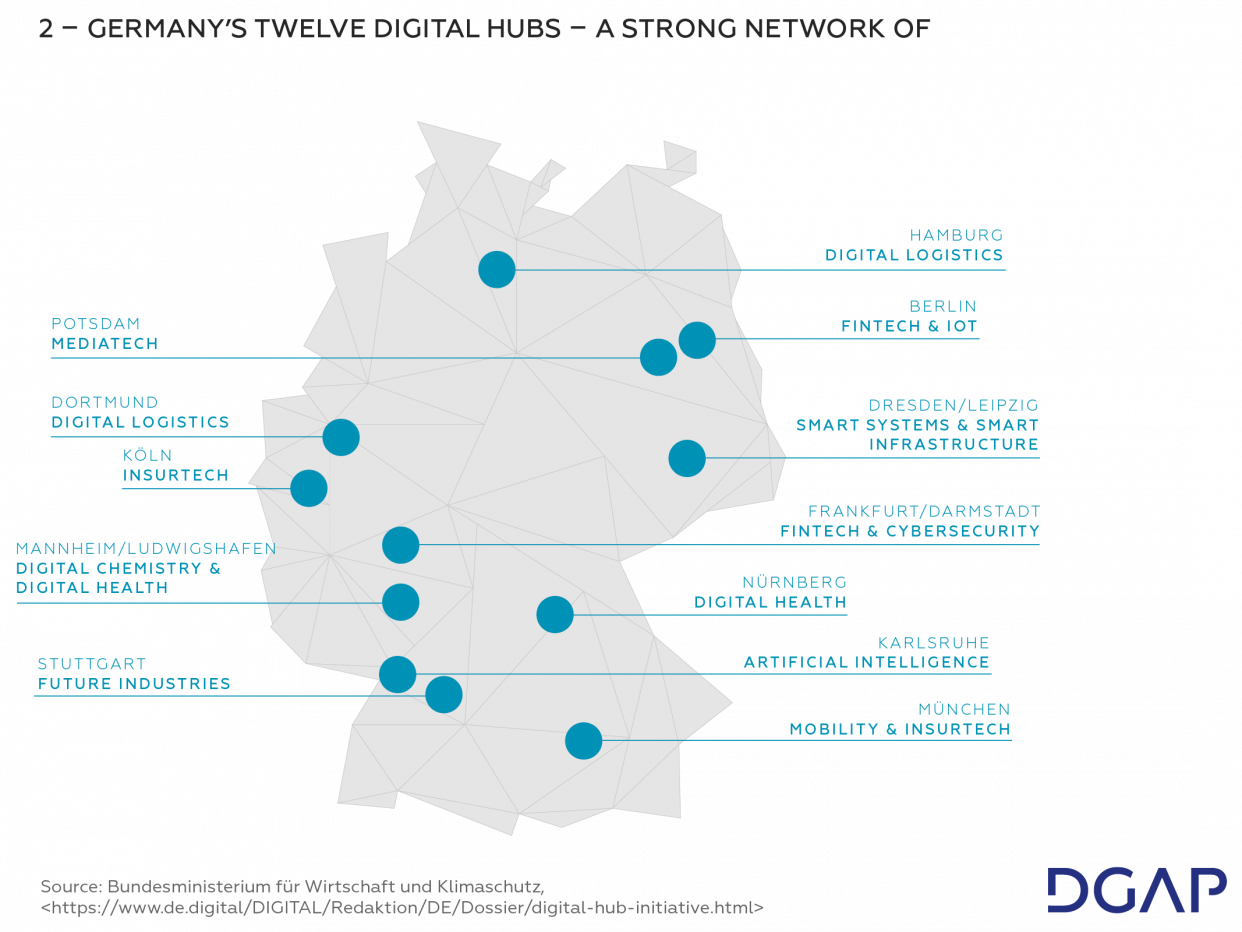

Commercializing research remains a challenge for Germany, however. For decades, the Central Innovation Program (ZIM) has aimed to promote R&D within the Mittelstand. But ZIM is underfunded and cannot meet demand for its services. It has accepted no new funding applications since October 2021. To help remedy the situation, the government launched the EXIST program in 2017, which fosters entrepreneurship and commercialization of academic research. A signature entity of the governing coalition, the planned Agency for Transfer and Innovation (DATI), represents another effort to commercialize German research. DATI would offer opportunities to test incentives for commercializing university research, support would-be academic entrepreneurs, and connect these individuals to the private sector. Finally, the Ministry of Economic Affairs and Climate Action’s Digital Hub Initiative aims to coordinate innovation among Germany’s 12 recognized, geographically-dispersed innovation hubs, which each specialize in a specific sector, to give local R&D and commercial technological strengths the capacity for nationwide scalability.

In addition, the Venture Tech Growth Financing Program, a pre-COVID-19 joint initiative of the government and the Kreditanstalt für Wiederaufbau (KfW), the country’s investment and development bank, provides startups with loans worth €50 million annually. Already in its first 100 days, the Ampel government outlined an ambitious approach with its first government-wide Start-Up Strategy, with a 10-point to-do list on everything from capital to data access. Most importantly, the Start-Up Strategy envisions that state and private pension funds will be required to mobilize a portion of their investment into VC. Together with the 2021 Zukunftsfund, this is an important stop-gap measure for the collapse in post-COVID venture capital, particularly for high-risk deep tech areas.

Paradoxically, the Ampel government has also begun to deprioritize funding for projects that facilitate technology ecosystems through scalability, interoperability, and open source development. In a fit of absentmindedness or, perhaps, by design, the coalition initially cut funding for DATI, digitizing education, the Gaia-X cloud architecture of standards, and the Sovereign Tech Fund to support open source software development for security, resilience, and technological diversity. Sacrificing these efforts to implement Germany’s post-COVID-19 fiscal consolidation could prove shortsighted by adversely affecting German downstream technology and cybersecurity innovation. Such limitations on R&D ecosystems in dual-use applications have traditionally weakened defense innovation, one of the greatest global sources of technological discovery, with spillover effects into economic and geopolitical competitiveness.

This trend is not new in Germany. The country’s universities and Hochschulen, led by the University of Bremen in 1986, have instituted so-called “civil clauses” (Zivilklausel) to restrict research to non-military applications. More than 70 German higher education institutions, including Berlin’s Technical University and the University of Tübingen, both of which conduct leading AI research, now have civil clauses. The strict separation of civil and military research is inconsistent with breakthroughs in critical and foundational technologies such as AI, quantum encryption, and advanced materials. The dual-use nature of these emerging and foundational technologies makes an artificial wall of separation between civil and military technology increasingly meaningless. Further, it is geopolitically disadvantageous given the increasingly central role that defense technology plays as a driver of general digital innovation ecosystems in countries such as the United States, China, Israel, the United Kingdom, and France.

Not everything on the academic front is bleak, however. Improved public administration funding, hiring processes, and competitive salaries have facilitated university education for foreign students and visas for skilled immigrants. Both developments are important since they provide entryways into the technology sector. Germany has also unwittingly gained from geopolitical developments since the 2010-12 eurozone crisis and the 2015-16 refugee crisis brought in highly-skilled European and global talent.

Recommendations

Germany must focus efforts in three areas if it is to bolster its global standing for fostering technology: 1) creating stronger funding streams for commercializing basic research, allowing dual-use R&D, and providing more durable financing for technology companies; 2) addressing scalability within the German federal system and throughout Europe via the digital single market; and 3) training, attracting, and retaining highly skilled IT specialists who power a future innovation industrial base. Specific measures include the need to:

Incentivize coordination among innovation-promoting institutions. Deeper cooperation among Germany’s innovation agencies is key. The Cyber Agency and disruptive innovation hub SPRIND have already declared an intention to strengthen their collaboration. Another step would be to create a national strategic technology council and a formalized interagency meeting process that includes the Central Office for Information Technology in the Security Sector (Zentrale Stelle für Informationstechnik im Sicherheitsbereich, or ZITiS) as well as Future Fund (Zukunftsfund), DATI and the Sovereign Tech Fund. The current government’s coalition envisions the establishment of the latter two. All these agencies would compare strategic objectives, test potential cooperation, identify broader obstacles, and consider research into dual-use technology and its applications. The greater transparency that would come from this would help avoid duplicative funding while increasing knowledge of, and access to, successful programs. The federal government should also create a dashboard of state (Länder) initiatives and promote asymmetric R&D and industrial alliances both among the German states and with the private sector in allied countries.

Emphasize complementarity between the Zeitenwende and German innovation in dual-use technologies. The €100 billion Zeitenwende outlay must link defense modernization with basic R&D capacity in dual-use innovation, including defense software. As part of the mentality shift in the Zeitenwende, Länder and universities must work with the federal government and the private sector on common-sense use of the Zivilklausel. Research universities must recognize the more general-purpose nature of technology and its funding sources.

Commit to reliable capital investment focused on industrial platforms, IoT, and deep and green digital technology. Despite the headwinds of austerity, inflation, and a global economic downturn, the German government should create domestic public investment incentives for strengthening its innovation industrial base. DATI, the Future Fund and the Sovereign Tech Fund aim to do this, but they are all in danger of being caught in fiscal consolidation and interministerial infighting. The technology sector would, in any case, welcome more government financing schemes. German startups identify public capital as their preferred source of funding (49.7 percent), followed by operative cashflow (43.4 percent), strategic investors (42.5 percent), and venture capital (42.2 percent). The government must provide strategic lifelines to allow for long-term planning and bolder innovation in key digital sectors. The Future Fund, itself, has aims to provide €10 billion in funding for start-ups. In the mid-term, Germany could look at a scheme to bundle the Future Fund together with institutional investment in a sort of embryonic German Sovereign Wealth Fund, with a proportion of funding specifically geared toward strategically important VC endeavors.

Create sandboxes – protected research spaces shielded from the constraints of regulation, red tape, and public procurement requirements – at publicly funded research institutions and agencies. Federal contracting requirements limit Germany’s ability to develop a globally competitive innovation ecosystem. Bureaucratic sclerosis, approval delays, and arbitrary timelines can squeeze, if not choke, innovation. Research institutions and innovation agencies would benefit from public sector funding requirements for contracting and tendering, evaluation, and long-term planning that can keep pace with rapid global innovation. Expedited processes would also help determine if government investment is prudent.

Encourage private sector engagement with “expeditionary investment” in, and acquisition of, technology champions and start-ups outside Europe. For most US and Chinese technology companies, mergers and acquisitions (M&A) has been central to building market power and absorbing innovation from other sources. Germany’s leading firms, supported by the German government, need to adopt an expeditionary or “going out” mentality for FDI to gain access to innovation breakthroughs, diverse organizational and management philosophies, and key intellectual property (IP).

Consider high-end R&D access in geostrategic terms. Offensive measures such as IP provision and adoption incentives and private sector collaboration aside, the new government should examine potential defensive instruments to prevent “IP leakage,” particularly in deep technology.

Recast the Digital Single Market as a geopolitical priority. Europe’s digital market fragmentation remains a stumbling block to scalability, a key hurdle to the bloc realizing its geopolitical potential in technology. Germany should lead efforts to complete the digital single market, including those aimed at encouraging the free flow of data and sector-specific data spaces across the EU, simplifying start-up registration, and building a unified capital market that encourages cross-border investment. These efforts will be especially critical for creating more pan-European open standards/open source software, thereby broadening the R&D supply base for resilient European-wide innovation.

Consider the ICT talent pipeline to be critical infrastructure. Germany’s immigration policies have begun to help its digital innovation ecosystem. The country has drawn human capital thanks to a university system that accommodates international students, liberalized residency and work requirements, and the ease of working in English. Germany now must elevate the attraction and retention of top IT talent to a national strategic objective. To do so, research institutes must offer the computing power, resources, research infrastructure, competitive salaries, and hiring flexibility that their American, British, and Chinese counterparts can.

About the Project

This DGAP project proposes an integrated policy approach to German digital capacities and objectives. Such a strategy should link Germany’s incumbent industrial strengths and digital governance objectives with its geopolitical aims.

This report outlines an integrated approach based on seven interdependent layers of a “technology policy stack”. For this analysis, the DGAP invited 38 individuals to join a working group and participate, between July and October 2021, in seven off-the-record workshops on the crucial strategic dimensions of Germany’s international digital identity. Participants included elected officials, candidates, and senior German government representatives; German political party staff responsible for platforms and coalition agreements; subject matter experts in technology and foreign policy; thought leaders and senior technology-company management; key academics, economists, and political theorists; and representatives of civil society and digital rights advocacy organizations. Additional experts were invited to take part in the workshops on an ad hoc basis. Each workshop focused on a layer in Germany’s technology policy stack. Working group members were consulted intermittently during the drafting of this report.

We are grateful to the Open Society Initiative for Europe for their generous support, which made this project possible.