|

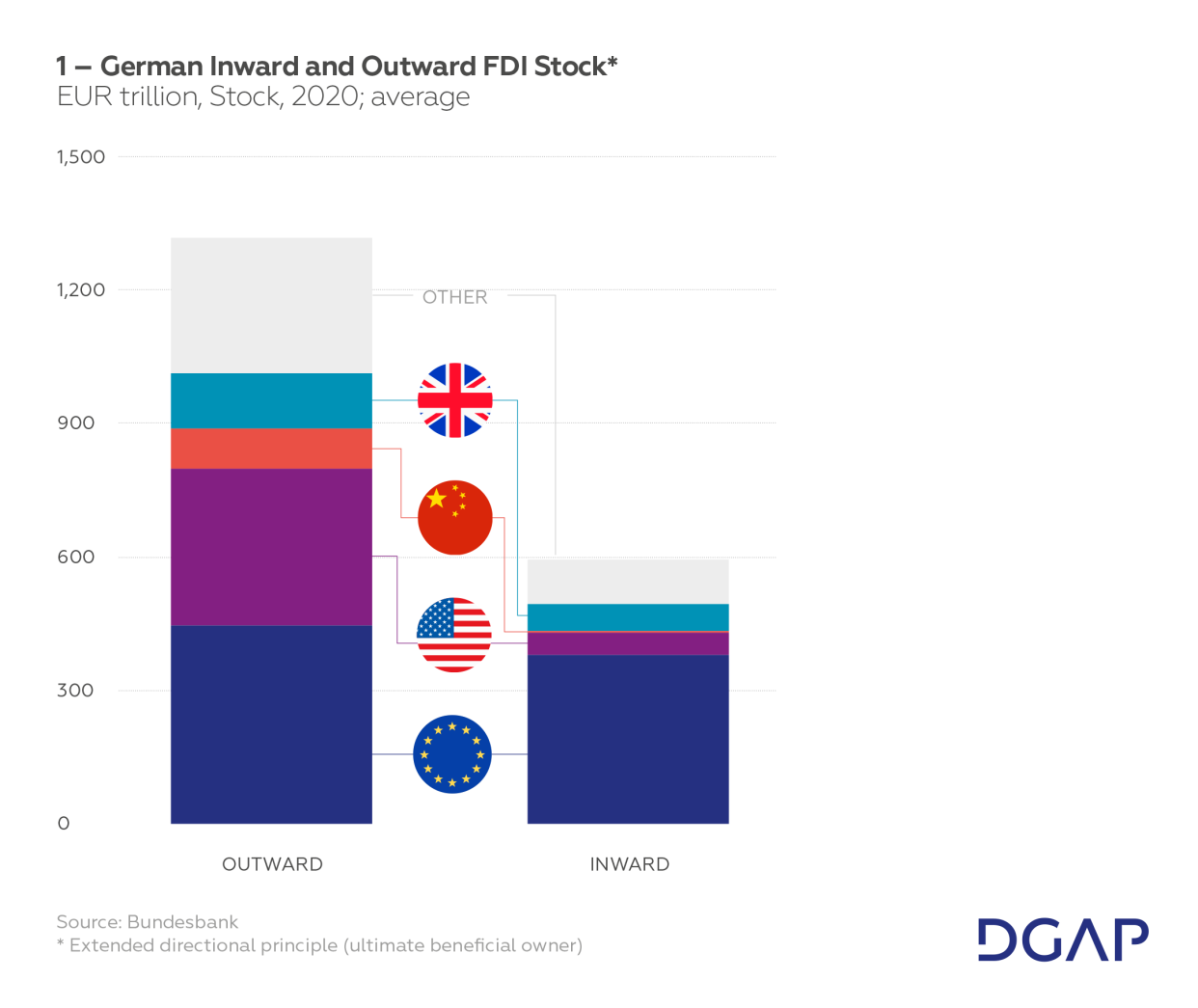

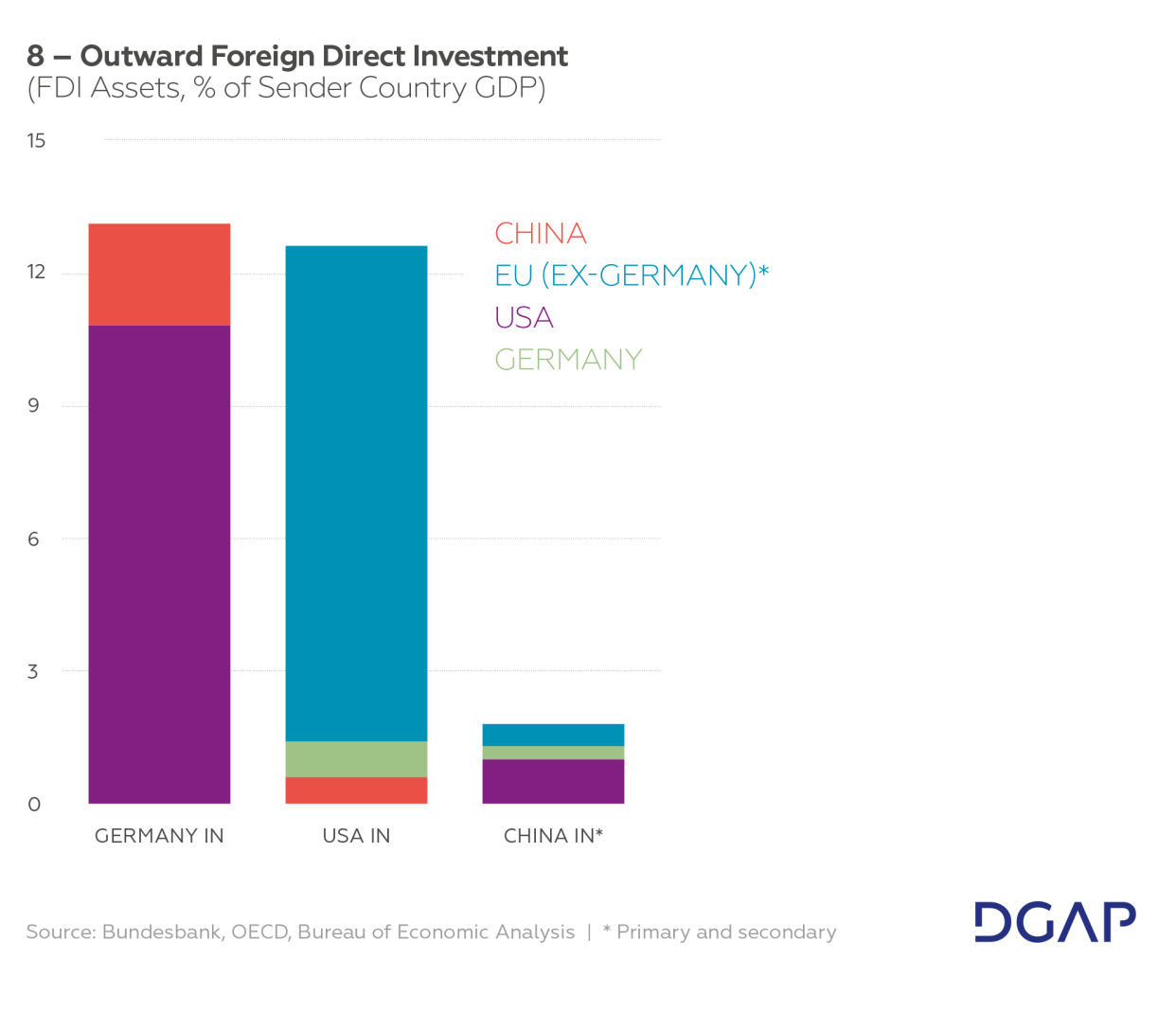

Germany’s outward FDI is concentrated in the European Union, the United States, and the United Kingdom. China and Russia account for a relatively small overall share of German outward FDI. However, the stock of FDI is only an imperfect indicator of associated supply chain vulnerabilities and technological leakage risks. |

|

The economic impact of German FDI policies – both the screening of inward investment and the promotion of outward investment – is relatively limited. Germany should conduct a review of its FDI policies in the context of its new national security strategy and provide estimates of the economic costs associated with mitigating FDI-related risks. |

|

A more coordinated EU approach to regulating inward FDI is highly desirable. It would help strengthen Europe’s position vis-à-vis third parties, whether in terms of pushing for a level playing field vis-à-vis China or coordinating inward FDI policies with the United States. |

The online version of the text contains no footnotes. To view the footnotes, please download the PDF version here.

What is Foreign Direct Investment?

Foreign direct investment (FDI) is defined as a non-resident natural or legal person acquiring control over at least ten percent of the equity of a company. FDI consists of equity capital, reinvested earnings, and intra-company loans. Unlike portfolio equity investment, FDI leads to a lasting interest in and a significant degree of influence over a company.

From the point of view of the recipient country, FDI provides benefits in the form of financing, the transfer of technology and managerial skills, as well as increased economic efficiency, all of which support economic growth, employment, and productivity. From an investor (or sender) country point of view, FDI can be market-, asset-, efficiency- and/ or diversification-seeking. FDI is market-seeking when its purpose is to gain access to another market by circumventing trade barriers. It is efficiency-seeking when the purpose is to cut costs by, for example, gaining access to cheap labor in the recipient country. It is asset- and resource-seeking if its purpose is to acquire complementary resources and capabilities, such as technology and commodities. From an individual investor’s as well as the sender country’s perspective, FDI can also help diversify risks and create more resilient supply chains.

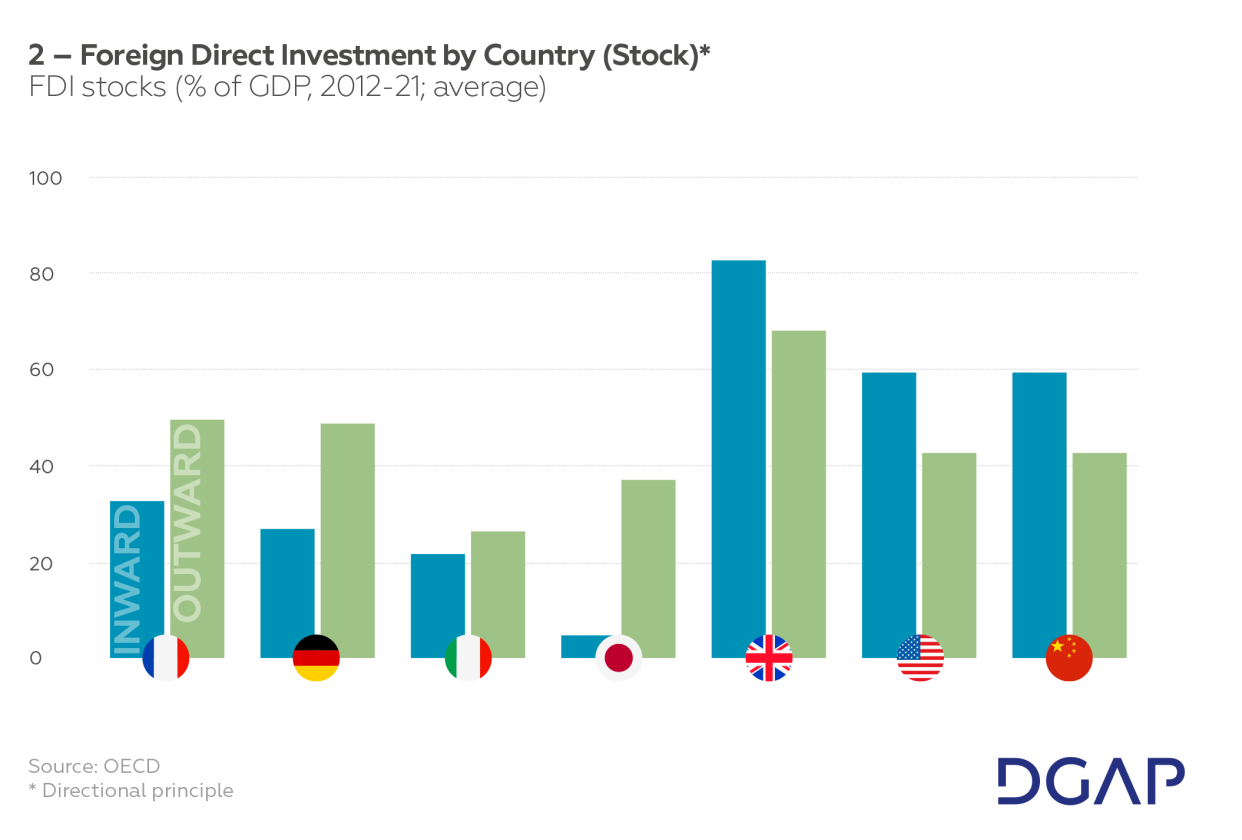

German outward FDI amounts to roughly 50 percent of GDP, and the bulk of it is in the European Union, the United States, and the United Kingdom. German FDI in China is significant but amounts to less than seven percent of total outward FDI. By comparison, German FDI in the United States is about four times as large. FDI in Russia accounts (accounted!) for less than one percent of the total. In euro terms, Germany’s primary FDI abroad amounts to EUR 1.4 tr, of which EUR 700 bn is held in EU countries. Germany’s primary and secondary FDI amounts to EUR 1.3 tr, of which EUR 400 bn is located in other EU member-states (and EUR 350 bn in the US).

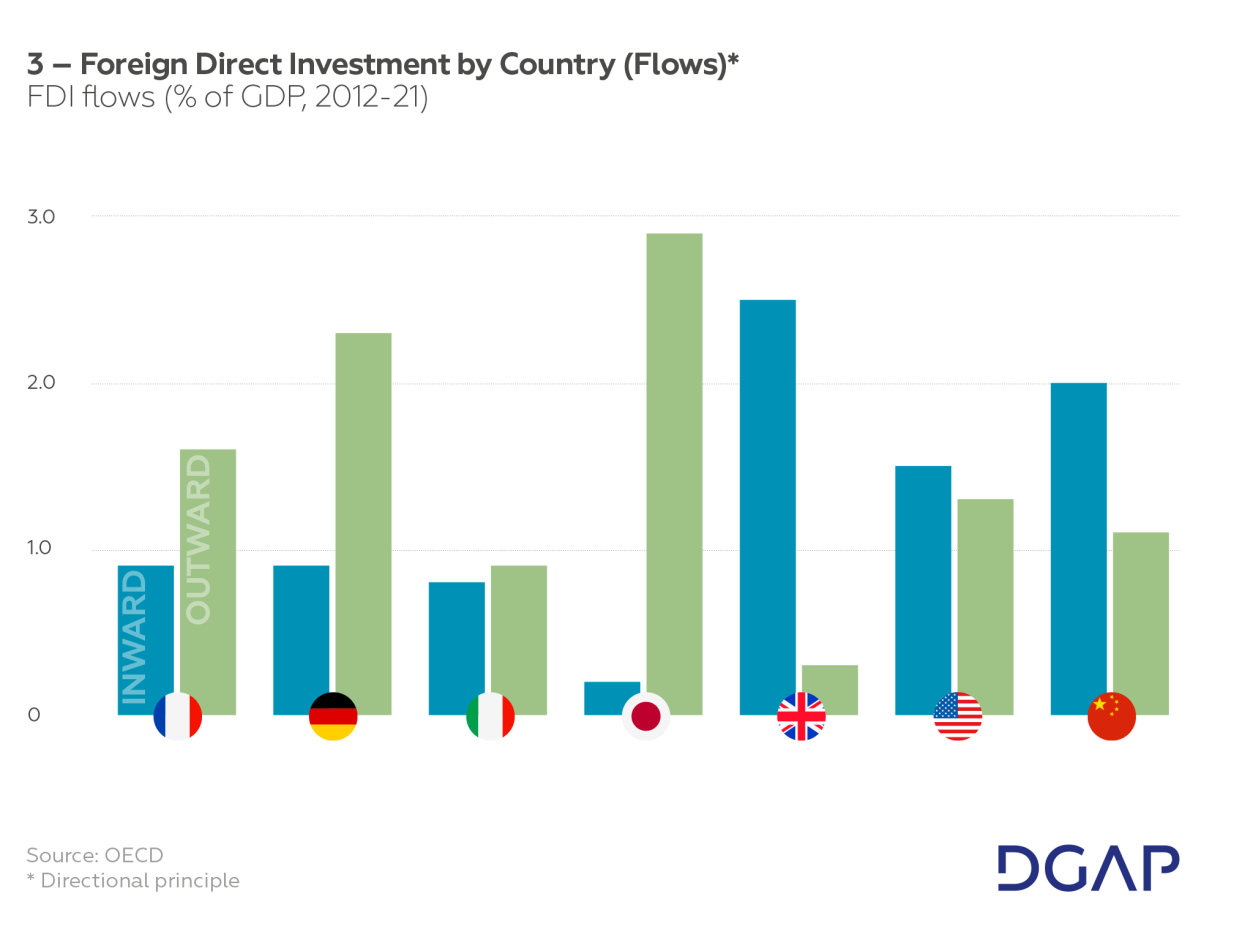

Measured as share of GDP, Germany has seen large FDI outflows over the past decade, worth more than two percent of GDP annually. FDI inflows have been comparatively modest. While international financial integration allows Germany to reap substantial economic benefits, it also makes it vulnerable to potentially adversarial policies by host countries. Such policies have the potential to disrupt supply chains and force technology transfer in addition to causing tangible financial losses to individual companies. The result is particularly painful if the government of the recipient country resorts to extreme measures such as expropriation and nationalization.

Foreign Direct Investment Policies

FDI has both economic and security implications. The latter are generally disregarded by standard economic models. For example, foreign companies may acquire critical assets by buying into companies involved in the production of essential commodities and technologies. They can then ‘lock them up’ or engage in other types of non-market behavior. For example, a foreign company owning local natural resources could decide to sell them only to customers preferred by its home country or itself, even though it could sell the commodities at a higher price domestically or elsewhere. (What constitutes non-market behavior is often difficult to determine in practice.) To what extent such concerns are valid is an empirical question and may vary depending on circumstances.

However, foreign companies that receive support from their home governments, and especially state-owned companies subject to direction from their home governments, are more likely to pursue non-economic goals. They may engage in uncompetitive, politically motivated behavior, which can cause security risks and technological leakage. Similarly, outward foreign direct investment may expose a company to political interference by it. This becomes more likely if the host government is not fully committed to the rule of law and liberal economic governance, or if the host country government is an actual or potential geopolitical antagonist of the home country.

In this context, it is worth distinguishing between the risks faced at company or at national level: On the one side, there are the financial costs incurred by a company because, for example, its overseas FDI has been expropriated. On the other side, non-market technological leakages or systemic supply chain disruptions cause losses for the entire economy. Clearly, from a national-level perspective, they weigh more heavily than the financial losses of individual companies. This is not to say that such losses can never be substantial. Several large German companies would find themselves in significant trouble if, for example, their China investment and business were to disappear overnight. But the consequences of technological leakage – in case of both inward or outward FDI – or supply chain disruption – in case of outward FDI – have a greater potential to cause critical economic disruption than the financial losses incurred by companies.

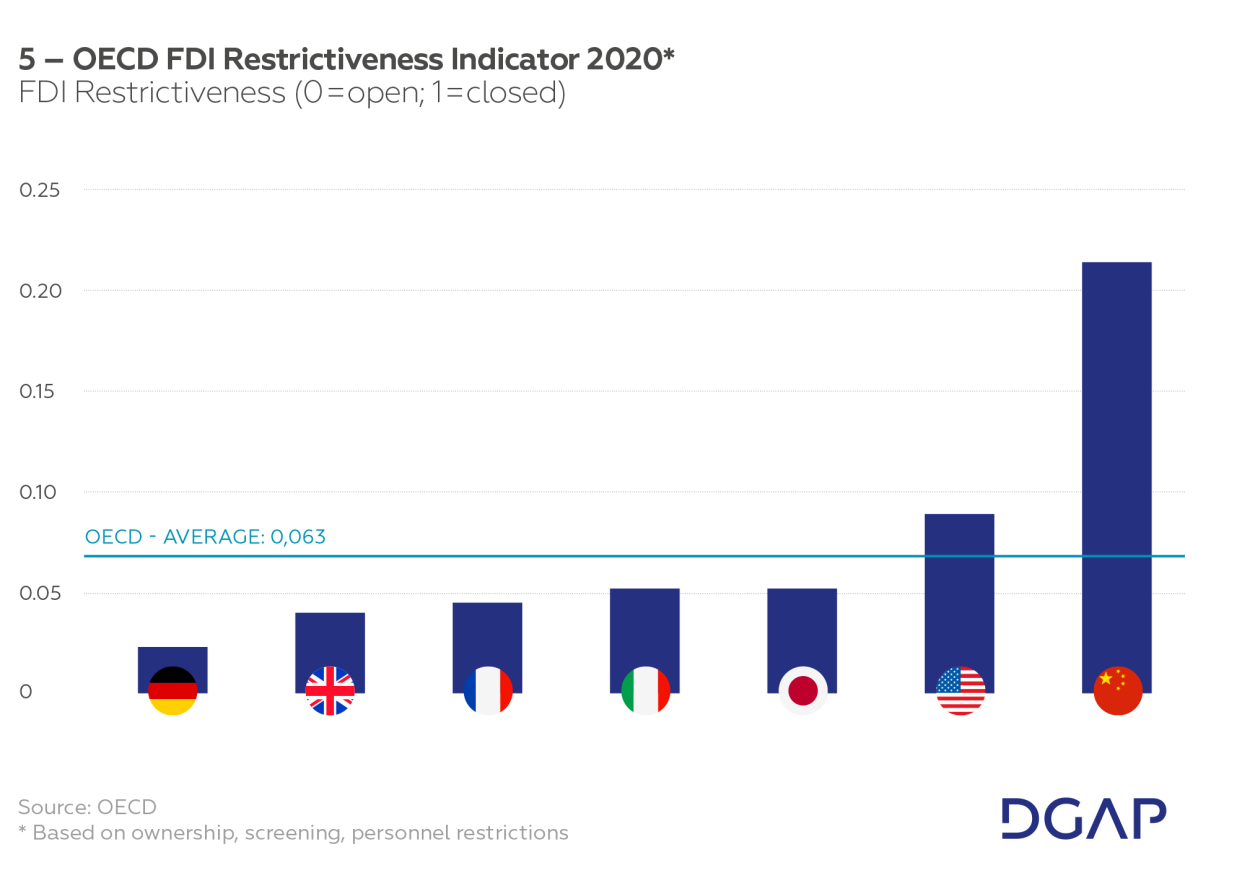

National FDI policies affect both inflows and outflows. The FDI regimes of advanced economies are relatively open, allowing residents to acquire foreign assets as well as giving non-residents relatively unfettered market access. In recent years, however, inward FDI regulation and screening have been tightened in many advanced economies due to concerns about national and economic security as well as technological competition. Some countries, like the United States, have even begun to consider restricting outward FDI (see box on page 5).

- RISKS RELATED TO RESTRICTING OUTBOUND FDI

-

Restrictions on outward FDI have historically been much more common in developing countries than in advanced economies, mainly due to balance-of-payments financing risks. But increasing concerns about technological leakage and supply chain risks have led governments in advanced economies to consider adopting a less laissez-faire approach to outward FDI. Washington is currently debating whether to introduce outbound FDI screening due to concerns about supply chain security, technology transfer, foreign government intervention, and espionage. In addition to export controls (including the foreign direct product rule), the recently passed CHIPS and Science Act bars US semiconductor manufacturers from producing advanced chips in China if they accept US government subsidies for the development and production of semiconductors. Last October, the US government further tightened export controls targeting China. FDI flows and even non-FDI flows are becoming increasingly ‘securitized,’ as US restrictions banning residents from investing in certain Chinese companies related to security or the military show.

The American inward screening regime, or the so-called Committee on Foreign Direct Investment in the United States (CFIUS), already gives the US government the authority to force the dissolution of joint ventures between US companies and their Chinese counterparts outside the United States. It is not difficult to see how the reach of US policies might be extended by limiting, for example, investments in the United States of companies that are majority German-owned but also have Chinese shareholders.

Restricting and Screening Inward FDI

The openness to inward FDI varies across countries and sectors. China, as an example of an emerging rather than an advanced economy, restricts investment in a significant number of sectors, and prohibits investment in others outright. In contrast, the United States has outright restrictions in only five sectors and maintains generally minor conditions in a few others. Germany’s FDI regime is among the world’s most open, in spite of the recent introduction of an enhanced national security screening mechanism.

Next to an outright prohibition of FDI in certain sectors, restrictions of inward FDI flows typically include: limiting the share of equity ownership in a specific sector that non-residents are allowed to hold; obligatory approval and screening procedures (ranging from pre-approval to post-notification); restricting foreign nationals from working in affiliates of foreign companies or mandating a minimum number of nationals on company boards; and operational restrictions on branching, capital repatriation, or land ownership. Moreover, there are often informal barriers that deter FDI, such as complicated cross-shareholding structures or onerous regulatory impediments.

| Inward FDI | Restricting | Prohibit or restrict non-residents from participation in specific sectors |

| Promoting | Provide economic and other incentives to attract FDI | |

| Outward FDI | Restricting | Restrict outward FDI in specific sectors or countries |

| Promoting | Provide political, economic, and financial support, including risk insurance, to outbound investment and bilateral investment agreements |

FDI Policies in Germany, the EU, and the United States

In Europe, the regulation of inward investment remains under the purview of EU member states. Germany has tightened inward investment rules several times since 2016. Sensitive industries, including defense and defense technologies, are subject to a mandatory review. Investment in other sectors may only be scrutinized if the investor is based outside the EU.

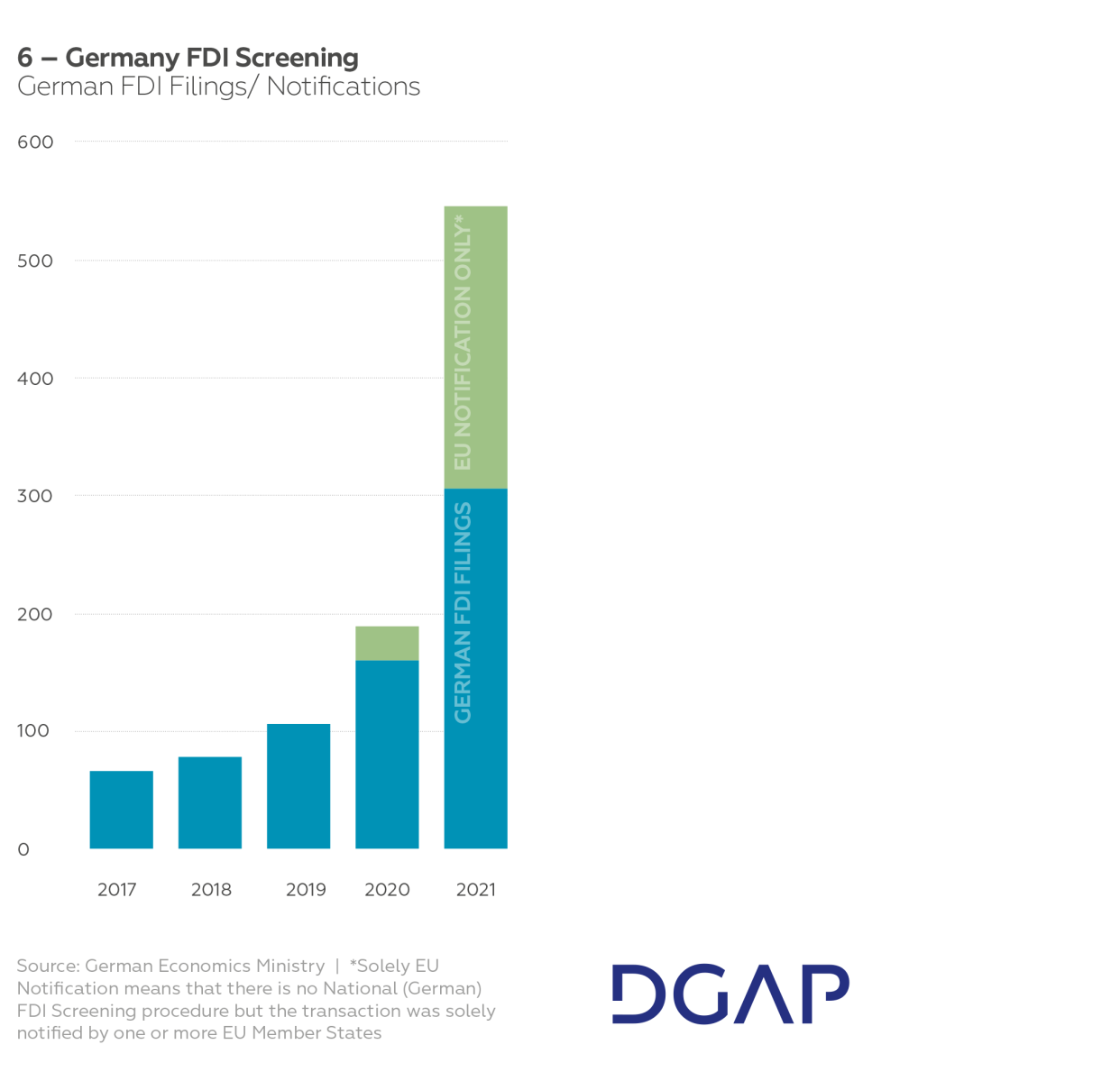

As a consequence of these recent changes, national-level FDI filings in Germany have more than tripled since 2017, reaching more than 300 in 2021. The authorities required ‘restrictive (remedial) measures’ in only 46 cases (or six percent) of a total of 716 cases filed during that period. Not a single investment seems to have been prohibited outright. Naturally, it is impossible to say how many FDI M&A deals were deterred in the first place by the tightening of the screening regime.

At the European level, the EU Investment Screening Mechanism came into effect in in 2020. It is meant to streamline and coordinate EU member state FDI policies toward third countries. Member states must notify the Commission of actions they have taken in the context of their national investment screening mechanisms. The EU screening mechanism also establishes procedures for member states and the Commission to quickly react to FDI-related issues pertaining to third countries by exchanging information and raising concerns related to specific investments. The Commission can issue opinions and set requirements for member states to adopt screening mechanisms at the national level to ensure “security and public order.”

In 2020, the EU investigated 20 percent of all FDI notifications and filings, meaning 80 percent of notifications did not lead to an investigation in the first place. And nearly 80 percent of the cases that were investigated were approved without conditions, 12 percent were approved with conditions, 2 percent were rejected, and 7 percent were withdrawn.

Like Germany, the United States has also tightened inward FDI regulations under the Foreign Investment Risk Review Modernization Act (FIRRMA) in 2016. CFIUS is significantly more restrictive than Germany’s FDI screening mechanism. Subsequent executive decrees and Treasury regulations have broadened the scope of CFIUS reviews. It now includes any non-passive investment in critical industries or emerging technologies as well as transactions in which a foreign government has a substantial direct or indirect interest. The law also allows the government to discriminate against specific foreign investors based on a ‘country of special concern’ label. Last September, the Biden administration issued an executive decree further tightening inward investment rules, including tighter scrutiny of investment in artificial intelligence, quantum computing, and biotechnology.

Promoting Outbound FDI

Governments can also seek to promote outward FDI flows. Similar to the way that they provide export credit insurance to promote exports, governments can provide insurance for outward foreign direct investment. In addition, governments can negotiate improved market access and enhanced safeguards in the form of Bilateral Investment Treaties (BITs) as well as in the context of Free-Trade Agreements (FTAs). The EU-Chinese Comprehensive Agreement on Investment (or CAI) is an example of a BIT.

FDI Policies in Germany, the EU, and the United States

The German Ministry of Economic Affairs and Climate Action (BMWK) provides political risk insurance for German companies acquiring overseas FDI assets. Political risk insurance typically covers nationalization and expropriation risks, war, convertibility and transfer risks, and sometimes the risk of breach of contract by local authorities.

In 2021, the German government approved EUR 2.6 bn worth of investment guarantees, compared to EUR 0.9 bn in the previous year. 12 out of 30 approved guarantees secured investments in China, amounting to EUR 2 bn (or nearly 80 percent of all guarantees). The stock of investment guarantees amounted to less EUR 30 bn last year. To put this into perspective, German GDP amounts to EUR 3,600 bn and annual FDI outflows to EUR 160 bn. The German FDI stock in China is currently worth EUR 90 bn. In purely quantitative terms, the FDI guarantees provided by the German government are not especially significant.

In the United States, various government agencies support outbound FDI, such as the Overseas Private Investment Corporation (OPIC), which in 2019 was merged with Development Credit Authority (DCA), which is part of USAID, to form the US International Finance Development Corporation (DFC). Focused on promoting American investment in less developed economies (read: America’s answer to China’s Belt and Road Initiative), the DFC provides political risk insurance, financing, equity, and technical assistance.

|

Notices |

Investigations |

Notices with-drawn during |

Presidential |

|

| 2009 | 65 | 25 | 2 | 0 |

| 2010 | 93 | 35 | 6 | 0 |

| 2011 | 111 | 40 | 5 | 0 |

| 2012 | 114 | 75 | 20 | 1 |

| 2013 | 97 | 49 | 5 | 0 |

| 2014 | 147 | 52 | 9 | 0 |

| 2015 | 143 | 67 | 10 | 0 |

| 2016 | 172 | 79 | 21 | 1 |

| 2017 | 237 | 172 | 70 | 1 |

| 2018 | 229 | 158 | 64 | 1 |

| 2019 | 231 | 113 | 30 | 1 |

| 2020 | 187 | 88 | 28 | 1 |

| 2021 | 272 | 130 | 72 | 0 |

Issues to Consider in Formulating National and European FDI Policies

Neither German inward FDI screening nor outward FDI promotion is very consequential in systemic, macroeconomic terms. Although FDI notifications have increased, the German authorities required ‘measures’ to be taken in only a small number of cases. True, it is impossible to say how much potential FDI was deterred by the enhanced screening procedures, and no data is available as to the size of the transactions that required remedial measures to be taken. But based on the available data (de facto) and existing rules (de jure), Germany’s FDI regime remains very open. Similarly, the share of German outward FDI that is supported by government insurance and investment guarantees is very small.

None of this means, however, that German and European FDI policies could not and should not be rethought, adjusted, and optimized – particularly in view of US-Chinese technological decoupling and the increasing securitization and weaponization of investment and trade policies by both Beijing and Washington. Germany and the EU need to strengthen their geo-economic defenses. They must go beyond the EU’s trade defense and import diversification policies to include investment and especially FDI. After all, the economic and security risks associated with both inward and outward FDI are much more significant than purely quantitative measures imply.

First, both inward and outward FDI policies should be formulated as an integral part of the Germany’s new national security strategy and address issues related to supply chain risks and technological leakage.

Second, the German government in cooperation with the private sector should conduct a thorough assessment of inward and outward FDI-related risks on a sector-by-sector and technology-by-technology basis. It should provide an assessment of the aggregate risks at the national level, which may differ from firm-level risks. The government also has an important role to play in terms of collecting information and monitoring national-level risks.

Third, having assessed the aggregate risks, the government needs to provide an estimate of the economic costs of individual and aggregate mitigation policies. It is this trade-off that should inform actual risk mitigation decisions. In this context, it should also be assessed to what extent domestic regulation may be effective in preventing technological leakage or non-market behavior of foreign-owned companies. If stringent domestic regulation is insufficient, enhanced inward screening and tighter regulation need to be considered. A similar assessment should be provided as regards German outward FDI and technology leakage risks. If the risk of technology leakage in a specific geography is considered to be unacceptably high, government intervention will be warranted. (This is less egregious than it sounds in light of a long-standing export control policy.)

Fourth, the government should then propose mitigation policies. Nobody is better placed to manage risks at the company level than the companies themselves. But collective action problems, information asymmetries, time-inconsistent behavior, and risks related to the behavior of complex systems, such as supply chains, warrant greater government involvement. In the case of outward FDI, absent official safeguards, companies may be tempted to trade future technological leadership for short-term profits (e.g., through a forced technology transfer). Private economic incentives and national security goals may not always be fully aligned.

In terms of inward FDI, the present mechanism should be updated to enhance the screening of investors from ‘countries of concern’ and of companies with close ties to foreign governments. In those cases, tighter rules may become necessary. In terms of outward FDI, the government should put in place safeguards to prevent the forced transfer of critical technologies with respect to countries where this is a material concern. The same should also apply to foreign jurisdictions where the risk of government interference or espionage is deemed high. The government should offer guidance on risks assessed by national-security related agencies such as the Federal Intelligence Service.

The government would also do well to consider using its investment guarantee policy to provide companies with incentives to diversify their foreign investment and supply chains and to guide them toward jurisdictions with lower geopolitical risks. In practice, this means eliminating guarantees or adjusting their price for investment in countries to limit (systemic) ‘concentration risk.’ Instead, guarantees should be provided on more favorable terms for countries where marginal investment helps improve aggregate risk diversification. (Once more, information about aggregate supply chain vulnerabilities will be crucial.)

Fifth, Germany should support the further development of the EU’s ‘trade defense’ instruments. This is not the place to evaluate the various policies the EU has been working on, including its anti-coercion, anti-subsidy, procurement tools. These aim to reduce EU vulnerbilities in light of the securitization of the foreign economic policies of Europe’s – and especially Germany’s – most important trade partners, China and the United States. Here, it would be desirable to draw up a broader strategy encompassing not only trade policy but also European FDI policies.

Last but not least, greater EU level coordination and integration of FDI policies are also desirable to provide the EU with greater leverage in negotiations over FDI policies with third parties. This would apply both in the context of creating more of a level FDI playing field vis-à-vis China and in terms of FDI policy coordination (and supply chain risk mitigation) with the United States. In particular, the EU should seek to coordinate inward, and potentially even outward FDI policies with the United States in the context of the EU-US Trade and Technology Council to avoid future transatlantic conflict over market access. American and European interests do not differ fundamentally, and Washington and Brussels should therefore be amenable to compromise. After all, supply chain security, technological leakage, the non-market behavior of foreign companies, and the political risk related to outward investment in high-risk or potentially geopolitically antagonistic countries are all concerns that are shared on both sides of the Atlantic.