Introduction

The Key Trends Defining the Geopolitical Tech Space in 2021

2021 Stakeholder Snapshot

Assessing Capacity to Act in 5 Key Enabling Technology Areas

Artificial Intelligence

Cloud Computing

Semiconductors

5G and Mobile Networks

Quantum Computing

Conclusion

Executive Summary

In the twenty-first century, technological innovation is driving geopolitical, economic and military competition. The US and China are leading the field. The risk of an emerging global bipolar technology environment is looming; one that could force third countries to come down on the side of the US or China. Europe is lagging behind in the global tech race and faces an uphill battle in its attempts to remain competitive.

The findings in this study show that Europe has quite a way to go if it wants to become as competitive as the US or China. In particular, European stakeholders from the private and public sector as well as civil society are worried about the EU’s overdependence on foreign-owned technology providers. These concerns are particularly acute in the realms where Europe does not have a strong indigenous industrial base, such as in cloud computing (76 percent express concerns), artificial intelligence (68 percent), and to a lesser extent by 5G mobile technology (54 percent).

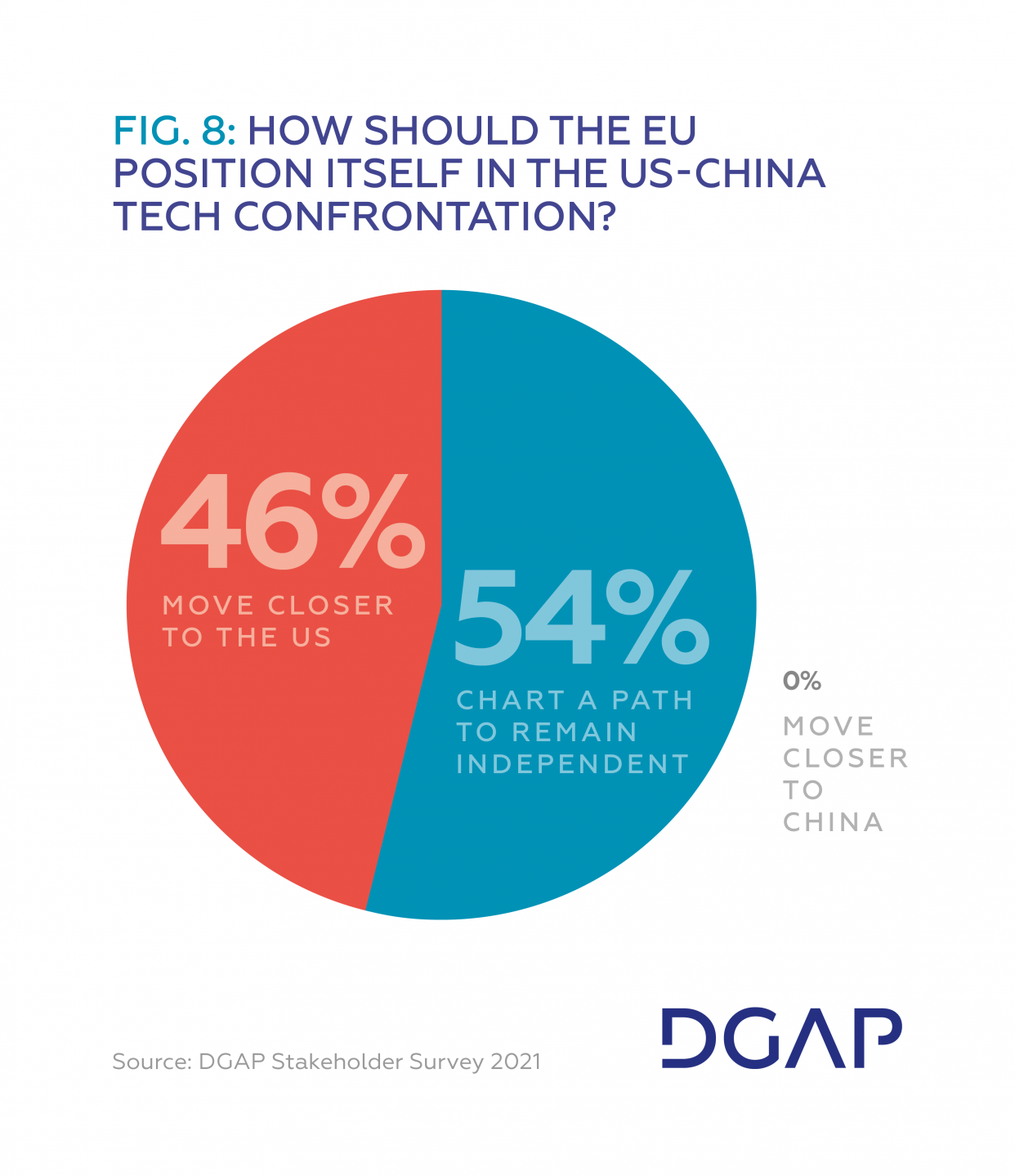

It makes a difference whether the EU is reliant on the US or China. The majority of stakeholders surveyed say that the EU relies most on the US for key technologies including artificial intelligence (80 percent) and cloud computing (93 percent) but also blockchain, high performance computing, and the internet of things (IoT). Only in 5G and mobile networks did respondents identify a larger dependency on China (65 percent). A slim majority (54 percent) believe the EU should chart an independent path between the US and China while 46 percent believe the EU should move closer to the US.

According to the stakeholders surveyed, the EU’s lack of first-mover advantage and absence of dominant home-grown tech players (such as Google, Microsoft, Amazon, and others) are the central obstacles to its capacity to act. But the EU does have levers it can use to turn the tides in its favor. When surveyed on the instruments available to Europe, stakeholders ranked the top four as: access to the EU market; global regulatory power; standard-setting; and data access and control.

There are five key technology areas that are set to define and shape the future of Europe’s capacity to act. These are: artificial intelligence (AI), cloud computing, semiconductors, 5G and mobile equipment, and quantum technology. We have assessed Europe’s strengths and deficits in each of these areas.

Artificial intelligence: The EU has stepped up its efforts to develop, deploy, and promote trustworthy AI. But there are three major hindrances preventing European competitiveness: Europe’s inability to commercialize its AI development; the lack of venture capital investment for AI start-ups; and the tension between need for data sets to train AI models and the EU’s strong data protection rules that make access to data sets difficult. The EU should further codify its values for international export. Together with its member states, the EU should also create large-scale public data pools usable for both AI research and AI application, because when the public sector leads in the adoption of AI-services, it accelerates AI take-up in other areas.

Cloud computing: Europe’s gap with the US and China on cloud computing is even more striking than in the field of AI. However, the EU is aware of this. With ambitious projects such as the European Alliance for Industrial Data and Cloud and GAIA-X, Europe aims to open up its cloud market. To succeed in this, Europe will have to learn from past mistakes and focus on driving down the costs of European cloud computing while driving up its reliability. Start-ups and small and medium-sized enterprises (SMEs) active in cloud computing should be supported through interoperability rules, while rules to protect citizens’ data should be enforced.

Semiconductors: Creating independent semiconductor capacity will be no easy task for the EU. And funds alone will not suffice to make European companies competitive. The task is rather to specialize in fields where the EU has incumbent strengths, such as chips for automotive, AI, and IoT devices. Instead of trying to compete directly with the US and the other world leader, Taiwan, the EU should instead focus on preserving and supporting local manufacturing capabilities as well as promoting open standards in chip design like RISC-V.

5G and mobile networks: Europe is somewhat better positioned on 5G and mobile networks compared to other areas. That partially comes down to the fact that there are no major US players in this space, but also because Europe’s two leading companies – Ericsson and Nokia – have the size and scale to credibly go head-to-head with Asian counterparts. The EU, via its innovation programs, should support intensive research in the field of 6G to maintain its strong position so that it is ready when the next development in mobile connectivity comes around. In addition, the EU and its member states should promote open standards for mobile communication networks.

Quantum computing: This technology is still in the early stages of development and its practical applications today are limited. But by 2030, it is likely to be a vital technology with projected benefit across a range of areas including communication, industry, and AI, among others. Germany and France are already pushing forward in this sector, but Europe more broadly must position itself as a frontrunner now to gain first-mover advantage and avoid falling behind, like it has in the semiconductor industry. The EU also has an opportunity to leverage its incumbent research strengths to successfully bring this technology to market. This means fostering innovation and public-private partnerships to develop the potential of quantum computing.

When it comes to the geopolitics of technology, the EU and its member states should make a priority of maintaining a globally interoperable internet and encouraging global innovation. Europeans do not always appreciate just how greatly they benefit from both of these things. To make this a reality, the EU should take the lead in the development of international coalitions with like-minded actors in standard-setting bodies and informal groupings for technology governance. And it should work out a strategy that fuels development, connectivity, and regional empowerment the Global South – a part of the world that Europe has, so far, not paid enough attention to when it comes to technology. Following the examples of the US and China, the EU must acknowledge the role that military and defense modernization can play in advancing its innovation industrial base.

If the EU wishes to assert its standards across all five technology areas, it has to take major steps to become competitive. Merely relying on regulation and leveraging access to the European market will fall short in the long term. That much is now clear. The EU needs to innovate, and if it fails in this, it will lose its capacity to act on the global stage. Furthermore, if the EU wants to be competitive it needs to complete the Digital Single Market and alter the culture behind it. Europe needs to reinvigorate its high-skilled workforce through flexible working conditions, education, and immigration, and remove blockers to the use of innovative technologies. A deeper culture of risk tolerance should be developed in which risk-taking and failing are accepted.

Introduction

Technological leadership has become a central dimension of geopolitical power. In this development, the primary front in the emerging tech power rivalry is between the US (United States of America) and China (People’s Republic of China). The European Union (EU) has fallen behind and needs to catch-up. The stakes in this race are high and will have an impact on economic competition, national security and broader values-based notions of political

order. This study sheds light on Europe’s approach to technological mastery.

The European Commission’s President Ursula von der Leyen has made EU tech leadership a top priority of her presidency and, beginning in December 2019, she has focused on boosting the EU’s role as a geopolitical actor by launching a multitude of initiatives, strategies and legislative proposals. Across European capitals, political leaders have been calling for ‘digital sovereignty’. This became a rallying cry, which served as a guiding principle for the EU’s digital policy during the 2020 German Presidency of the Council of the EU.

This study looks into the progress of the EU and its member states across selected technological fields and their global entanglements with other nations and technology actors. First, five trends – currently defined by the interplay between digitalization and international politics – will be examined to provide the necessary background and showcase the urgency of action needed. Second, the concept of ‘capacity to act’ will be outlined and positioned in the context of the EU’s contemporary tech policy discourse. Third, a Stakeholder Snapshot will provide quantitative insights into how key stakeholders perceive the geopolitical dimensions of the European tech-landscape. This data includes perceptions of the EU’s key dependencies and the instruments at hand for strengthening European resilience and leadership in technology. Fourth, a selection of crucial technology areas that will shape the future will be assessed. Among these are artificial intelligence, cloud computing, semiconductors, 5G and mobile connectivity, and quantum computing. Each of the sections will include a qualitative assessment of the state of play and general policy approach, while also providing specific policy recommendations. Finally, some general conclusions will be drawn on how the EU and its member states can enhance their technological competitiveness.

1. Key Trends Defining the Geopolitical Tech Space in 2021

Five major trends currently define the world’s technological and political environment. These are the trends that motivate the EU towards action and demonstrate the urgency with which the bloc needs to act. The five trends that stand out in particular include:

- Technology’s key role in ensuring geopolitical, economic, and military competitiveness;

- The gradual trend of US-China digital decoupling;

- Digital authoritarianism;

- New technological dependencies and vulnerabilities brought on by COVID-19;

- New renaissance in tech-industrial policy.

All of these trends are interlinked with the great power rivalry between the US and China, which is increasingly defined by the race for technological leadership.

The overarching question for European policy makers is how the EU and its member states fit into this great power rivalry and how they can credibly compete for leadership and mastery in digital technologies between these two great powers.

1.1 Technology’s Key Role in Geopolitical Competitiveness

Technological leadership is fast becoming one of the key areas of geopolitical, economic, and military competition. The many use cases, or general-purpose character of several key technologies, is blurring the lines between previously distinct domains, such as economy and security. For example, advances in image recognition algorithms that can be used for commercial purposes, might also be used for mass surveillance or for identifying objects on a battlefield. Quantum technology that can be used for domestic manufacturing, might also be employed to detect stealth aircrafts, or to break encrypted or otherwise secure networks. Governments and companies that are able to achieve mastery of key enabling technologies and adopt them more easily, will have enormous economic and political power levers at their disposal. Actors that are unable to keep pace, will be forced to expose themselves by depending on other countries for those essential technologies.

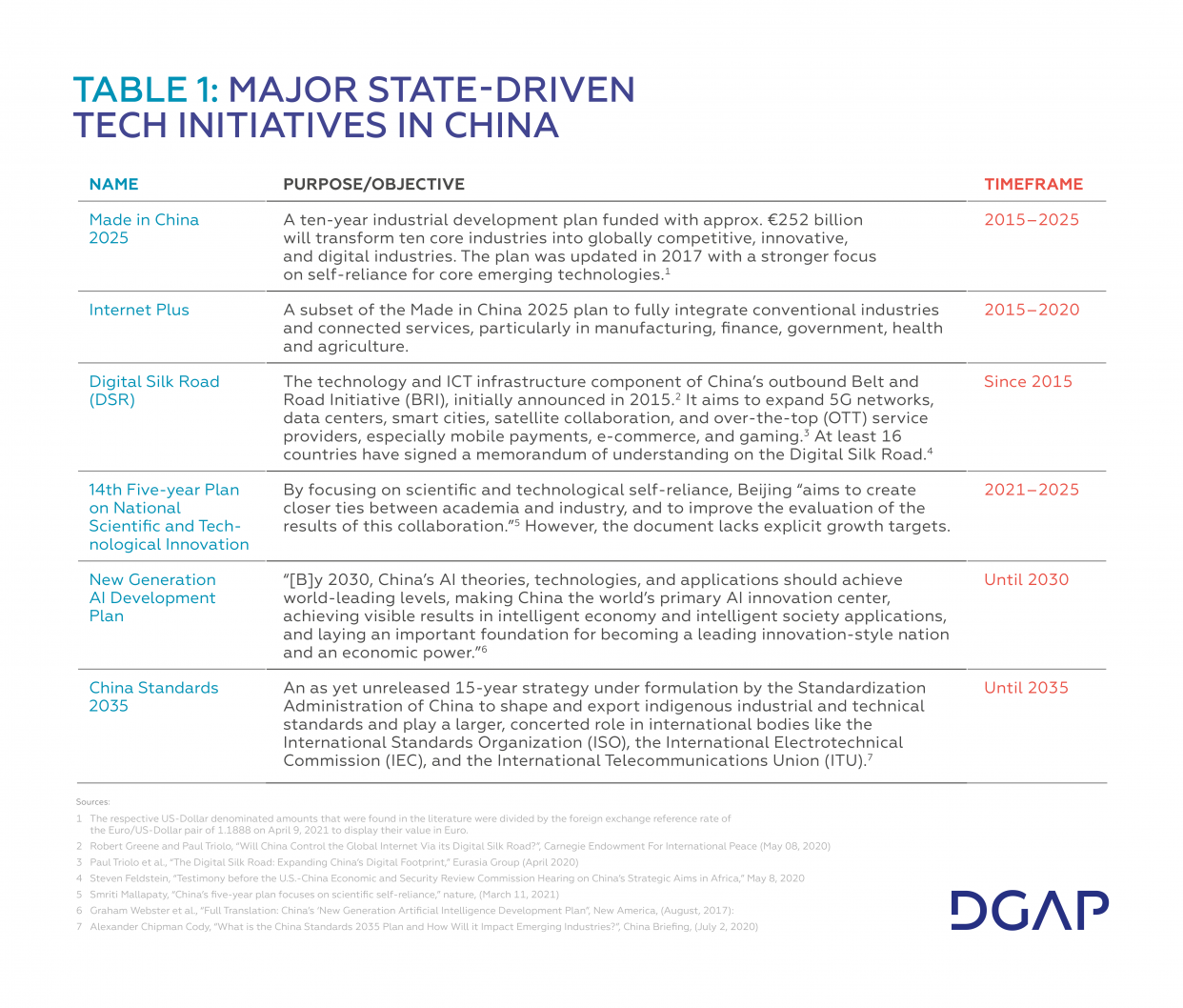

Given the growing importance of technology for ensuring economic and military competitiveness, it should come as no surprise that the emerging great power competition between the US and China is increasingly defined by the quest for technological leadership. The Chinese Communist Party (CCP) has rolled out a range of strategic initiatives aimed at enhancing technological capabilities (see Fig. 1), while China’s President Xi Jinping has made it clear that science and technology leadership are “key to military upgrading”.[1]

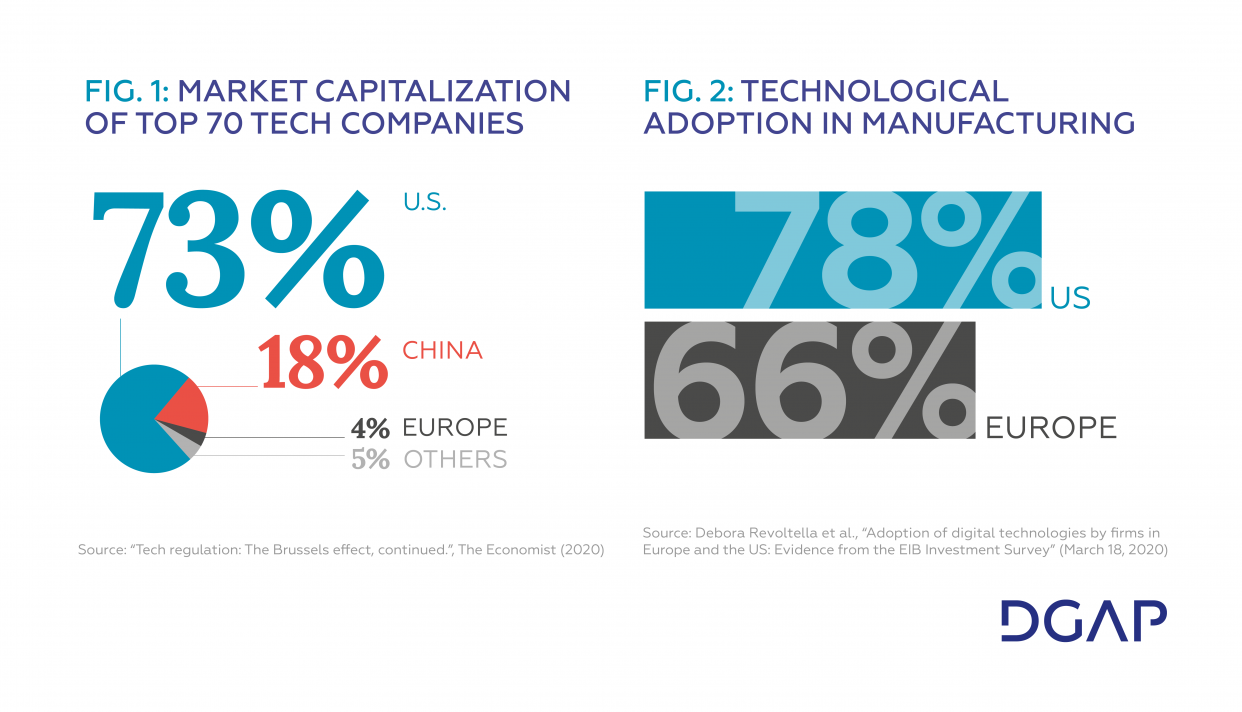

Due to the importance of the private sector for developing cutting-edge technologies, countries need to develop and nurture a thriving innovation sector at home. Today, big tech companies in the US and China are among the world’s best capitalized businesses. For context, seven of the ten largest companies in the world by market capitalization are in the tech space and out of those, five are US-based and two are from China.[2] These tech companies have become engines of growth, productivity and, most importantly, innovation. Be it IBM and Google in quantum computing; Amazon and Microsoft in cloud computing; or Baidu in machine-learning, tech companies have become the locus of cutting-edge innovation at a level previously reserved for top universities and government R&D programs.

The gap between European technology companies and American and Chinese technology giants is significant. European companies count for less than 4 percent market capitalization among the world’s 70 largest digital companies, compared to the US, whose companies represent 73 percent and China’s, which represent 18 percent.[3] Venture capital, which is the lifeblood for new and innovative tech companies, has surged in Europe in 2019 and is up 40

percent since 2018, attracting €29 billion of capital to European tech companies.[4] But that is still considerably less than US and Chinese venture capital firms put on the table, as US based companies raised €114 billion and Chinese based firms more than €34 billion.[5] The low level of investment in indigenous European technology has created the conditions for non-European acquisitions, such as Google’s purchase of UK-based AI company DeepMind.

1.2 The Gradual Trend of US-China Digital Decoupling

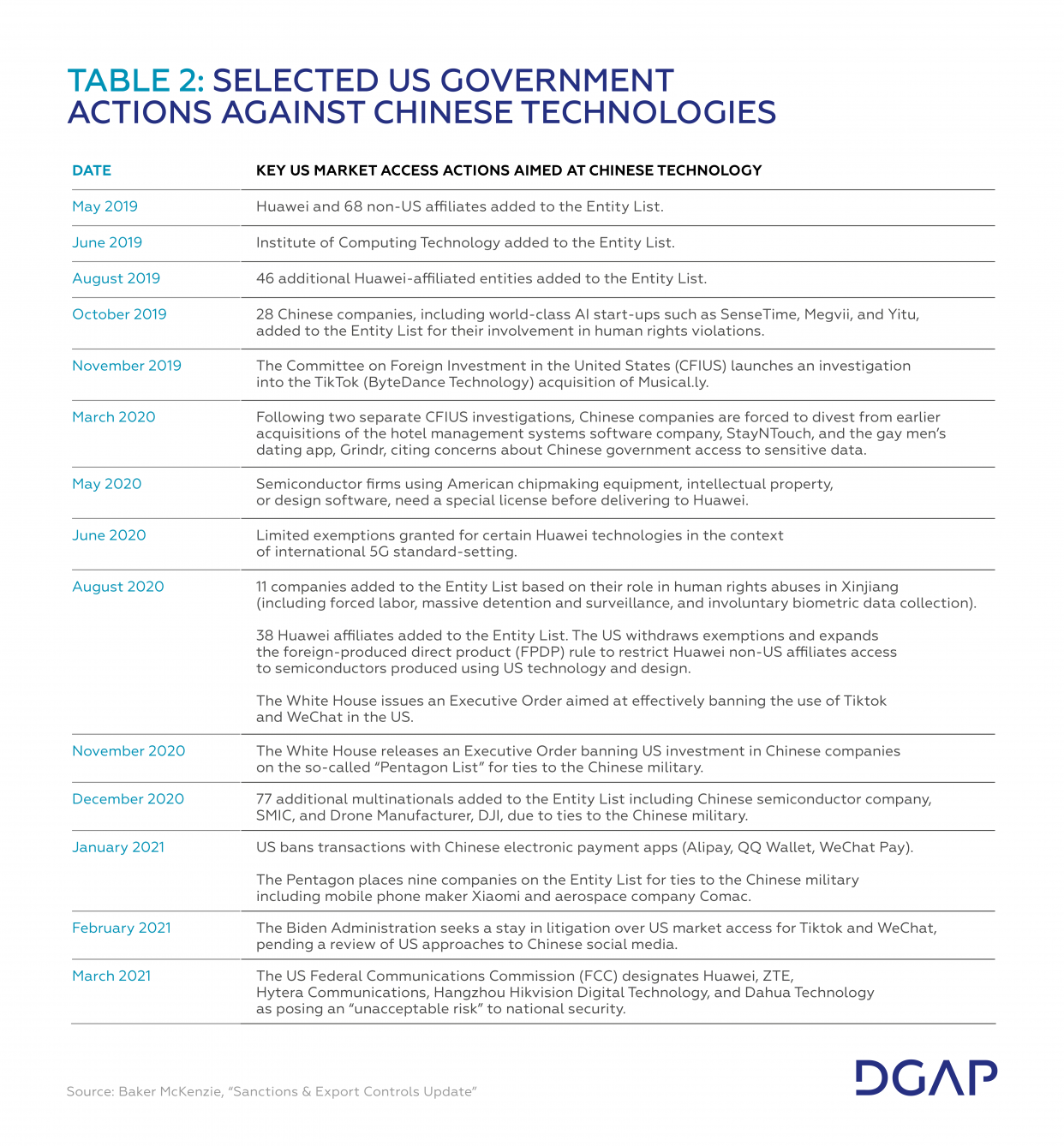

As the US and China try to outpace each other by developing and adopting new technologies, they are also in the process of cutting their reliance on each others’ technologies. This is the so-called digital or technological ‘decoupling’. When taken to its logical conclusion, decoupling could lead to two separate tech stacks evolving: one led by the US and one by China. Each tech stack would have its own supply chain network, innovation system, standards, and protocols. At some point the EU and its member states might have to ask whether they want to set up their own third stack. And if the answer is no, then the EU may have to decide which tech stack – and by proxy which country – to align with. Even though the emergence of two perfectly distinct systems is not realistic in the foreseeable future, the trend towards decoupling raises questions about Europe’s strategic orientation.

Export controls and sanctions imposed by the US on China have also increased the extent of decoupling. For an example of how these sanctions and controls play out, we only need to look at the case of Chinese telco Huawei. Google’s discovery of data security vulnerabilities when people installed Google apps or a Google OS on Huawei handsets resulted in Google blacklisting the company. Subsequently, the US government banned companies from doing business or collaborating with the company. In response, Huawei is now developing its own HarmonyOS. Furthermore, US chipmakers were forced to cut off supplies to Chinese companies, after the US government added them to the Entity List (see Table 2).

Beijing – motivated by such restrictions and its own strategic aspirations for end-to-end control – is gradually striving for digital self-reliance through investments in its own domestic tech-industries and by reducing its dependence on other suppliers. China has taken the logic of control so far as to seek other elements of digital decoupling in the field of internet governance by exploring the idea of cutting the country off from the World Wide Web and setting up “national internet sovereignty”. Something that already exists in China in the form of the “Great Firewall”, which significantly reduces information permeability.[6]

The US reasons for decoupling span questions of economic competitiveness and national security. The perception in Washington, shared by the Biden Administration, the former Trump Administration, and large bipartisan majorities in Congress, is that China has taken advantage of the open American market and innovation cooperation while simultaneously using the opportunity to steal intellectual property and engage in forced technology transfers, all as a means to develop China’s own innovation industrial base. Washington also has concerns about the security risk posed by Chinese technologies – in particular the use of commercial products for espionage and disruption – due to the strong link between the Chinese tech industry and the CCP and military.

1.3 Digital Authoritarianism

Technology is becoming a vehicle for exporting and enforcing ideologies. While technologies may have once been seen as emissaries of digital democratization, they are increasingly used to enforce digital authoritarianism with “[n]ew technologies…enabl(ing) high levels of societal control at a reasonable cost.”[7] The tools for effective digital authoritarianism already exist, including AI-enabled surveillance systems (e.g. facial/gait recognition technology), spyware on mobile phones, and internet censorship, to name a few.

Countries setting an example by using those technologies can inspire others. Not only like-minded autocrats, but also vulnerable democracies who could set norms for the use of invasive technologies. To see this approach in action, we need only look at China’s “Great Firewall” and the example it sets. Countries such as Vietnam and Thailand have already debated copying China’s model. Chinese experts are also reported to have supported government censors in Sri Lanka and to have supplied surveillance or censorship equipment to Ethiopia, Iran, Malaysia, Russia, Venezuela, Zambia, and Zimbabwe, among others.[8] As technology-driven authoritarian models of governance become more apparent in fragile democracies, the concept of liberal democracy will find itself under new pressure.[9]

Since the very beginning of the COVID-19 crisis, the discussion surrounding digital authoritarianism has gained new impetus as several states – especially in Southeast Asia – have employed new technologies such as AI surveillance to detect whether citizens are wearing face-masks or not, and social tracing apps to enforce quarantine orders. Critics see the use of these technologies in aid of public health as a gateway to normalizing broader and more authoritarian uses in the future. Even in European states such as Germany, France, the United Kingdom or the US, a debate has flared up concerning the use of technologies to mitigate the spread of the COVID-19 virus and to strike the right balance between using tech for good and honoring each citizen’s right to have control over their personal data.

1.4 Technology Dependencies and Vulnerabilities

The COVID-19 crisis has helped propel technology adoption forward around the world. Cloud-based services, in particular, have gained rapidly in usage and popularity. But this has revealed four key dependencies and vulnerabilities that Europe now faces::

- Chinese market: The growth of the Chinese economy during the COVID-19 crisis has amplified European – particularly German – dependencies on the Chinese market for IoT and Industry 4.0 exports. In 2020, amid Chinese GDP growth and a recession in Europe and the US, China overtook the US as the EU’s most important trade partner. This makes key European countries like Germany dependent on China and adds sensitive questions about economic relations to any decisions about potentially banning Chinese 5G vendors, for example.

- US platforms and cloud providers: Widespread tech adoption throughout Europe during the COVID-19 crisis has intensified reliance on US web services and cloud hosting providers.

- Third-country supply chains: COVID-19 revealed how brittle (tech) supply chains can be as Europe has faced bottlenecks on a range of products from semiconductors to vaccines.

- Cyber-security: The COVID-19 crisis has opened up new vulnerabilities for state-backed active measures, mis-/disinformation, IP theft, and cyber-spying. One example was the hack of the European Medicines Agency, which resulted in vaccines data being leaked. New IT-based threat vectors impacting European democracy, prosperity and potential for physical harm.

Taken together, these trends show potential vulnerabilities in Europe’s technological ecosystem that must be mitigated.

1.5 A New Renaissance in Tech-Industrial Policy

The growing worldwide trend toward tech industrial policy is unmistakable. In many ways, China has been a forerunner in the resurgence of this trend. China’s technological development efforts have drawn greater global attention since 2015 when it launched its Made In China 2025 plan, which was updated in 2017 to put greater emphasis on creating domestic autonomy in key emerging technology areas. China’s use of industrial targets and import substitution industrialization[10] to boost its indigenous technology companies, helps to incubate domestic enterprises and provide fertile ground for them to scale up. Other factors bolstering China’s domestic tech sector include generous state-backed investments in the form of both subsidies and state financing, procurement structures that preference state-favored companies, forced joint ventures, and sharing of technology IP gathered through state-backed industrial espionage with copy-cat companies at home. All of these factors help to create a codependent technology ecosystem for China, in which the CCP is the undisputed senior partner.[11]

For the US in recent years, the story has been different. The US was heavily reliant on the private sector to push its technology industry forward. But now the US is also preparing more government-focused support for its innovation industrial base. American tech industrial policy is driven by a sense of national mission, linked to national security and seen through the lens of the US-China great power conflict. The US is now eyeing an increase in public spending through both defense and civilian channels to maintain its leadership in key emerging technologies.[12] The Biden administration is currently putting aside €252 billion for the development of emerging technologies including AI, 5G, 6G and electric vehicles as elements of the president’s Build Back Better recovery plan.[13]

Europe has also gotten serious about having a more interventionist industrial policy. In 2019, France and Germany began thinking about what a more serious approach might look like. They issued a 14-point Franco-German Manifesto on European Industrial Policy in which they laid out Europe’s 2030 outlook in stark terms: “The choice is simple when it comes to industrial policy: unite our forces or allow our industrial base and capacity to gradually disappear.”[14] France and Germany outlined specific focus areas, including massive industrial investment, changes to Europe’s regulatory framework, and new measures to protect Europe’s industrial base. This document pointed favorably to new policy developments around Important Projects of Common European Interest (IPCEI) that allow for greater state aid to be deployed and ensuring public procurement access and trade policy operates in service of strategic autonomy. Finally, it also emphasized the need for greater competitiveness of European enterprises and championed more active screening of foreign investment. Other initiatives such as the cloud and data infrastructure project GAIA-X, which was initiated by the German and French governments and designed to develop common requirements for a European data infrastructure, are heading in a similar direction.

The COVID-19 crisis and the vulnerabilities it exposed have pushed Europe to rethink EU-level industrial policy, including in key technology areas. The EU will allocate 20 percent of its Recovery and Resilience Facility (RFF) to digitalization and technology investments. Embryonic cooperation on five new IPCEIs is already underway on mobile network equipment, semiconductors, cloud and data innovations, hydrogen power, and batteries. And the European Commission has drafted its so-called “Digital Compass 2030” – an action plan for digital competitiveness – with concrete tech development targets and a monitoring process for the next nine years.[15] These efforts are complemented by multilayer initiatives at the national and regional levels. Germany, for instance, has ambitious industrial R&D plans, investing €2 billion in quantum computing, €5 billion in AI and €2 billion in 5G. Industrial policy initiatives are also taking place at the regional level, for instance in Baden-Württemberg’s Cyber Valley, Europe’s largest AI consortium, and Bavaria’s Quantum Valley. Generally, Europe’s tech industrial agenda is ambitious and heavily informed by geopolitical circumstances. Questions remain, however, as to how the EU can translate its objectives into effective action and to what extent it will enlist like-minded democracies in its efforts.

1.6 From “Digital Sovereignty” to Capacity to Act

The EU must find new ways to assert itself technologically amid the fierce competition between the US and China. The push for digital or technological sovereignty or a “European third way” are buzzwords often heard thrown around. The prevalence of these buzzwords signals a deep desire and strategic need for technological autonomy. But the question of how the EU can achieve that goal remains unanswered.

The term digital sovereignty refers to the concept of self-determination and independent decision-making in the digital space.[16] Nevertheless, the term itself is used so often that it is has lost much of its meaning. Consequently, digital or technological sovereignty is sometimes mistaken for digital or technological autarky – an idea that fails to consider the level of globalization and inter-connectedness in today’s supply chains, in particular regarding technologies.[17] And while sovereignty in a strict sense might make sense in the analog world, it has significant limitations in the digital space, due to the borderless nature of the internet.

The call for a “European third way” brings with it other misconceptions.[18] One interpretation concerns the EU’s distinct regulatory and ethical emphasis on developing technologies. In this way, EU tech would focus on Europe’s human-centred or value-oriented approach with regard to technology to differentiate it from the US, which is considered more “hands-off” and profit maximizing, and China, which is state-driven and oriented toward social control. Another view builds on the concept of a third European tech stack or sealed-off supply chain that eliminates third-party dependencies. Those notions have recently been brought forward in light of the US-Chinese trend towards decoupling and the danger of the EU having to align with one great power or the other in these uncertain times.

Both interpretations have their limitations. The human-centered approach is based on the EU’s regulatory power but neglects the industrial and capabilities side. The idea of a European IT stack can be reduced to just describing a push for technological import substitution industrialization (ISI) or even autarky.

Against this backdrop, the following study puts forward the concept of the EU’s “capacity to act in the technological realm” – at least as an interpretation of “digital sovereignty” - in order to describe the EU’s prospects and opportunities in the digital age.

Introduction

The Key Trends Defining the Geopolitical Tech Space in 2021

2021 Stakeholder Snapshot

Assessing Capacity to Act in 5 Key Enabling Technology Areas

Artificial Intelligence

Cloud Computing

Semiconductors

5G and Mobile Networks

Quantum Computing

Conclusion

2.1 A 2021 Snapshot of Stakeholder Perceptions about Europe’s Capacity to Act in the Global Tech Race

To gauge perceptions of Europe’s access to and control of key technologies, over 2,500 key experts working on European technology and digital policy in government, industry, think tanks, academia, parliaments, and civil society were asked to participate in a survey, key results of which are presented here. The selection of potential participants was based on expertise in the European tech landscape and familiarity with the issues at hand. One hundred and twenty-six people participated. Respondents hailed primarily from Europe, with stakeholders from Berlin and Brussels heavily represented. The survey was conducted between January 12 and February 5, 2021 and all responses were fully anonymous.

2.2 Taking Stock of Europe’s Technology Dependencies

The survey first attempted to establish a topography of Europe’s perceived dependencies across seven technology areas mentioned in the EU’s 2020 Digital Strategy.[19] Three trends stood out:

- The perception among participants that the EU’s dependencies are most pronounced in cloud computing (76 percent “agree” or “strongly agree”) and artificial intelligence (68 percent), followed to a lesser extent 5G mobile technology (54 percent).

- Stakeholders remain largely neutral on the question of over-dependencies in blockchain technology, high performance computing, and quantum technologies. Each of the three have been less present in Europe’s political discourse around the geopolitics of technology, although that is slowly changing.

- Participants demonstrated the greatest confidence in Europe’s IoT performance. But even here, approximately one third of respondents either agreed or strongly agreed that Europe is too reliant on external actors.

When drilling down into the EU technology dependencies, the survey showed that the EU is perceived to depend most on the US compared to any other state, including China. This is particularly true in cloud computing (93 percent see the EU as dependent on the US) and artificial intelligence (80 percent). On blockchain, high performance computing (HPC) and IoT, the US was seen as the primary source of dependence. Only in 5G and mobile networks did respondents identify a larger dependency on China (65 percent).

Respondents were asked to provide a baseline assessment of these seven emerging technology areas according to the same three-tiered framework that was used for assessing US technological standing in the October 2020 White House National Strategy for Emerging and Critical Techogies.[20] Respondents could rate the EU as a “technology leader” in which independent, world-leader capabilities should be achieved; a “technology peer” where capabilities are linked to interdependence; or “risk management”, where dependencies on external actors could lead to strategic and geo-economic vulnerabilities.

For most technologies, a plurality of respondents perceived the EU as a “technology peer” when assessed against other technology powers. This reflects some degree of confidence in Europe’s innovation industrial base. In cloud computing (67 percent) and 5G/mobile networks (44.4 percent) more respondents saw the EU in the “risk management category”. But a significant number also perceived Europe to be in a “risk management” position on other technology areas, including artificial intelligence, blockchain, HPC, and even IoT – a finding that indicates an acute awareness of the risky position the EU is in. Europe is not seen as a leader in any critical technology area, although 5G/mobile network equipment (20 percent) and IoT (16 percent) had the highest level of respondents classify Europe as a technology leader. These results indicate a level of precariousness in the EU’s 2021 baseline position in key technology areas.

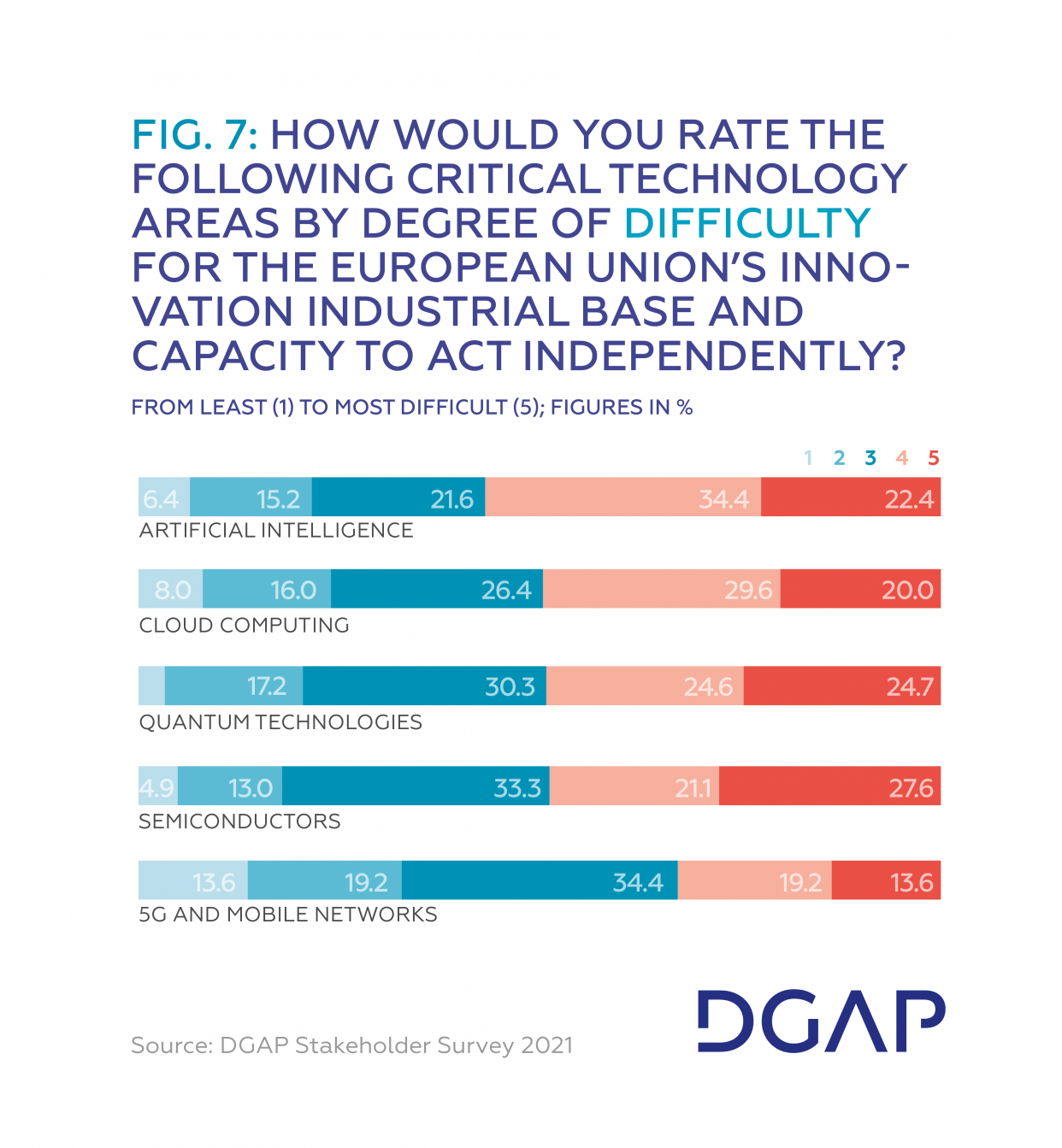

2.3 Europe’s Standing in the Five Enabling Technology Areas

When starting to focus on how the EU should prioritize, the survey narrows focuses on the five key enabling technology areas identified as significant for Europe’s innovation industrial base and capacity to act independently: artificial intelligence, cloud computing, 5G and mobile network equipment, and quantum technologies. In all these areas, the sense of exposure is great. A majority of respondents assess all five as important for Europe’s capacity to act, with artificial intelligence (75 percent rate it as important or very important) and 5G and mobile networks (73 percent as important or very important), as particularly acute. The enormity of the challenge of addressing the EU’s dependencies is also daunting, particularly in the areas of artificial intelligence (56.8 percent rate it as difficult or very difficult), cloud computing, semiconductors, and quantum technology (each rated difficult or very difficult by 49 percent of participants).

In 2021, the United States is seen by stakeholders as the global leader in four of the five technologies. In AI, 60 percent of respondents named the US as the global leader; in semiconductors, 43.5 percent; in quantum technologies, 57.7 percent; and in cloud computing, an overwhelming 95 percent perceived the US as the dominant country. Only in 5G and mobile networks was China perceived as the global leader by 72.5 percent of respondents.

The picture shifts markedly eastward when asked to assess key technologies in 2030. In two of the five key technology areas, participants expect China to overtake the US: in artificial intelligence (55 percent) and semiconductors (47 percent). China is expected to continue its leadership in 5G and mobile network equipment although its leadership is expected to shrink to 63.8 percent from 2021 to 2030. The US is expected to maintain technological leadership in cloud computing (66.9 percent agree or strongly agree) and quantum technologies (63 percent agree or strongly agree) in 2030. Europe is not expected to become a global leader in any of the five key technology areas, although the percentage of those expecting greater European tech leadership increases across all five technologies between 2021 and 2030.

2.4 Mapping European Strategies and Obstacles

When asked about how the EU should position itself amid a US-China tech confrontation, stakeholders are almost evenly split. A slim majority (54 percent) believe the EU should chart an independent path between the two, while 46 percent believe the EU should move closer to the US (see Fig. 8). This reflects very live debates in European capitals about how to shape industrial policy and market access vis-à-vis the US given the already existing dependencies. None of the respondents felt Europe should move closer to China.

The survey also gauged expert views across 12 potential obstacles to Europe’s capacity to act in the digital technology space (see Fig. 10). On each issue, respondents were asked to rate each obstacle on a scale of importance between one (least important) and five (most important) as a hindrance to Europe’s technological leadership in a global context. They were then asked to rate the same obstacles by the degree of difficulty for Europe to overcome them.

Two broad findings stand out in this data:

- Respondents perceive a generally noticeable positive correlation between difficulty and importance across issues. This is consistent with some of the challenges recognized for generations, like availability of venture capital investment and commercialization of research.

- By far, respondents saw Europe’s lack of first mover advantage and absence of dominant incumbent tech players as a central obstacle to its capacity to act. Respondents were able to prioritize across obstacles with some areas where the EU has shown strength – like basic R&D and public-private partnerships – which are perceived less difficult and less important to Europe’s quest for digital sovereignty.

This is not meant to be a comprehensive list of policy and economic conditions informing Europe’s digital competitiveness landscape. Important issues were left out. Issues like levels of connectivity and the incomplete digital single market clearly also play important roles in shaping Europe’s position in the world. But this composite snapshot captures many of the key potential barriers addressed by policy makers and analysts when assessing Europe’s standing in global tech leadership.

2.5 Europe’s Global Objectives and Instruments on Tech Policy

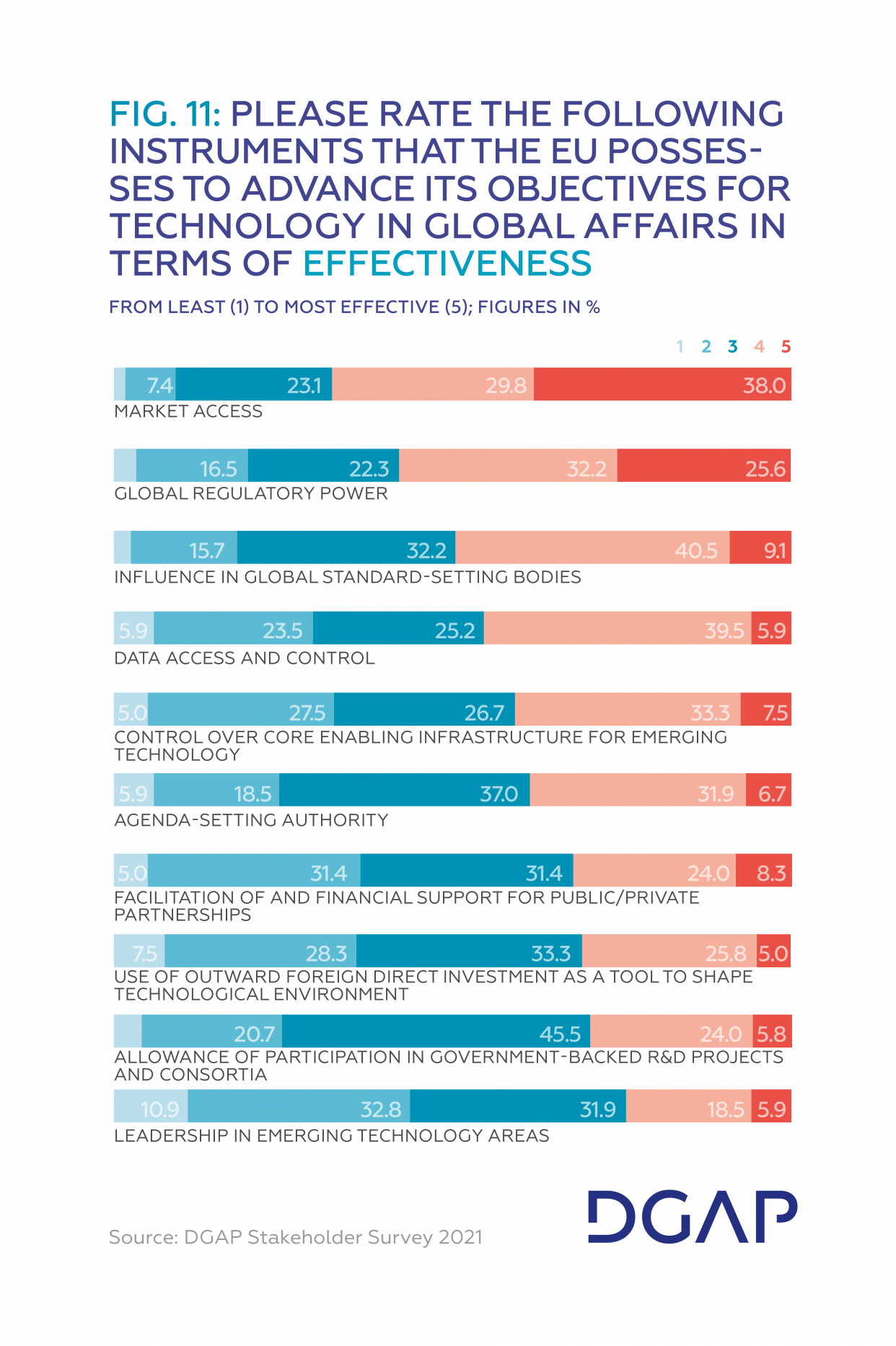

On Europe’s global objectives (see Fig.11), two issues stand out and clearly reflect the policy priorities on emerging technology in Brussels and many capitals across the EU.

The first is pushing for greater competitiveness in emerging technology areas, which is by far seen as the most important priority and also something that is relatively difficult to achieve. Europe’s efforts in this area – spanning the digital single market, regulation to open new spaces for technology competition, and industrial policy – remain at the center of the European Commission’s digital agenda.

Second, is the use of emerging technologies to improve sustainability and lower carbon emissions. Climate and tech competitiveness are followed by a cluster of global objectives, including cyber-stability, digital rights, global digital rules, and an open global Internet. All areas are seen as moderately difficult to achieve.

Discovering how to employ emerging technologies in military contexts is seen as both the most difficult potential objective and the second least important. New efforts to build stronger connective tissue between NATO and the EU on emerging technology might raise the profile of this cause. But currently it remains a relatively low priority. More strikingly, the role of tech access and adoption in the Global South is perceived as both the least difficult and least important objective for the EU. This could reflect the more inward-looking nature of EU member states but could also emerge as a blind spot if policy does not take into account the linkages between tech adoption in developing countries and other objectives like competitiveness, the ability to make global rules, and the shaping of digital rights.

The EU has a few useful tools at hand that can help advance its global tech objectives. The first is the EU’s regulatory framework. Market access and Europe’s ability to use its regulatory weight to pull people around to its own values feature prominently in stakeholders’ minds, with significant numbers identifying these regulatory tools as very effective. The ability of the EU to influence global standard-setting – likely the result of the preponderant influence of Europe’s leading standard-setting bodies including the European Committee for Standardization (CEN) and the Committee for Electrotechnical Standardization (CENELEC)- and the development of frameworks like the General Data Protection Regulation (GDPR) – turn countries around the world to the EU’s way of doing things.

Interestingly, European outbound foreign direct investment (FDI) is seen as a less effective instrument in the EU’s quest to achieve its global technology objectives. Given the role of US FDI as an instrument of American tech leadership and rising awareness of Chinese FDI, such as Tencent acquisitions in the European mobile gaming industry and AliCloud’s data center acquisitions, it’s interesting to see that this tool is not perceived as particularly effective for the EU to advance its global interests. The situation is similar in the case of public-private partnerships. Perception of European innovation leadership in emerging technology areas is by far seen as the EU’s least effective potential instrument.

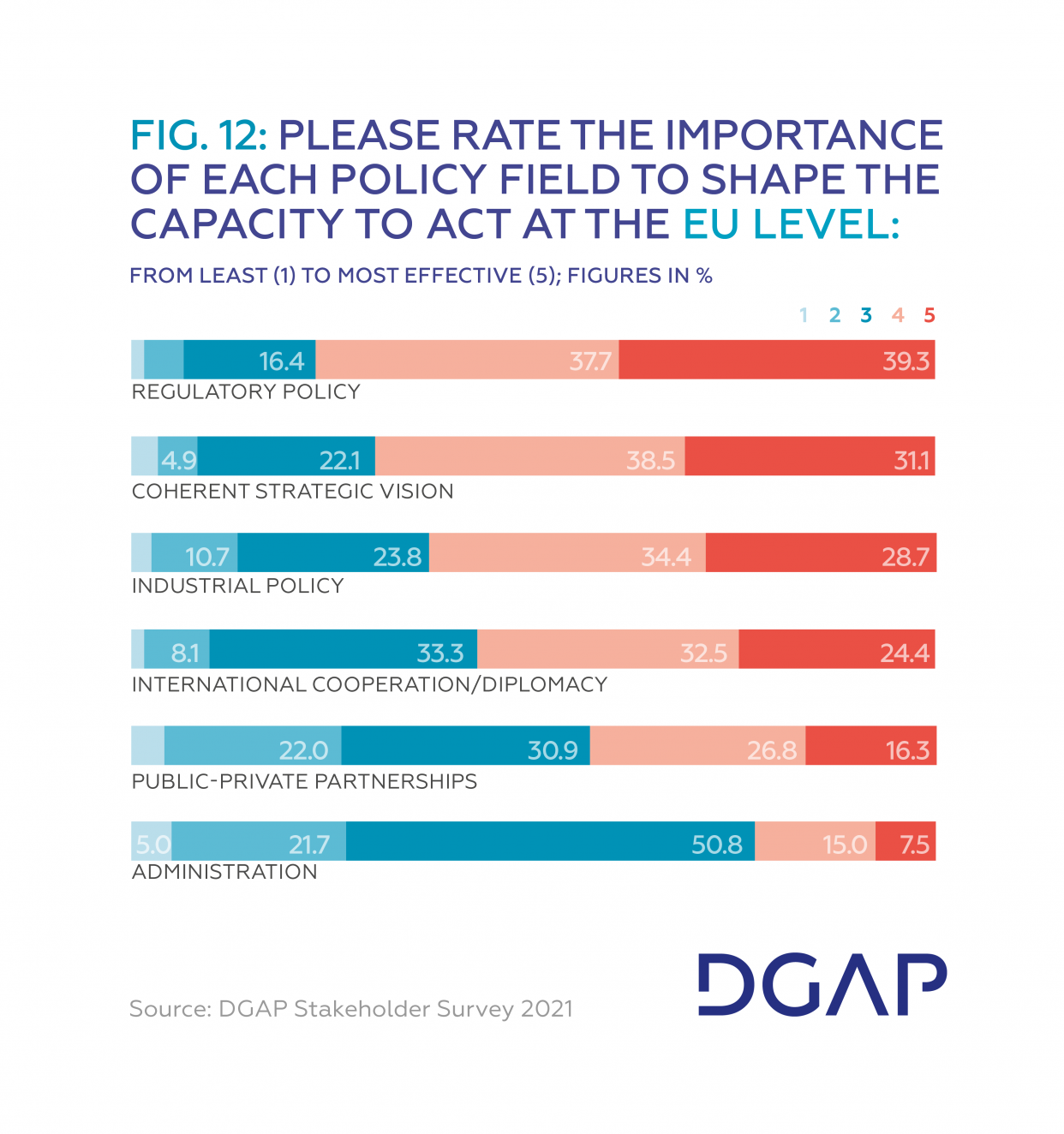

The data also reveals clear trends around how participants feel tech policy should be managed between the EU and national levels. On the EU level, overwhelming majorities saw four key policy drivers: industrial policy, regulatory policy, strategic vision, and international cooperation. Of those, a majority ranks “regulatory policy” as most important (77 percent rated it as important or very important). This is unsurprising given the EU’s high-profile role in digital regulation and its ambitious regulatory agenda around the Digital Services Act, the Digital Markets Act, data governance, cloud rules, and cybersecurity. Respondents also attach a great deal of importance to the EU’s role in shaping a coherent strategic vision for tech policy (70 percent rated as important or very important). However, in this area, the role of member states is also rated highly, although slightly less than the EU, suggesting recognition of a desire or need for multilevel coordination, where both the EU and individual member states have a role to play.

At the member state level (Fig. 13, the aggregate response places the greatest importance on each member state’s ability to shape an effective industrial policy (60 percent rated it as important or very important). This is not to say that the EU should not play a role in industrial policy. According to the stakeholder response, both EU and member-state roles in industrial policy are important. The member state role is also seen as slightly more important in establishing public-private partnerships.

Interestingly, a significant number of participants saw the EU’s role in fostering international cooperation as more important than that of individual member states. We could attribute this coordinating power across 27 member states is better suited to shaping Europe’s technological capacity to act in a global context in a coherent way. Some participants felt that the EU should take the lead on this, with 30 percent saying that the member states are of little or no importance in international digital cooperation.

Introduction

The Key Trends Defining the Geopolitical TEch Space in 2021

2021 Stakeholder Snapshot

Assessing Capacity to Act in 5 Key Enabling Technology Areas

Artificial Intelligence

Cloud Computing

Semiconductors

5G and Mobile Networs

Quantum Computing

Conclusion

The Stakeholder Snapshot makes Europe’s exposure acutely apparent. It also points to some of the instruments the EU has and obstacles it faces in its quest for peer and leadership status in key technology areas. This section takes a deeper look at each of the five technology areas to provide an overview of the field, analysis of current policy approaches, and practical recommendations for how the EU can push forward in each area. The five technology areas are consistent with those mentioned above: AI, cloud computing, semiconductors, 5G and mobile equipment, and quantum technology.

The content in this section is based on reviews of key literature and primary source material, interviews with relevant actors, and quantitative inputs from the stakeholder survey. The stakeholders in the survey also provided additional analysis and policy recommendations, and the survey results inform the recommendations we have made for each technology area. For each technology we look into the state of play and current policy approach to ground our recommendations.

Here’s what is meant by those terms:

The State of Play covers the industrial and technological capabilities in current global value chains. But also includes how able actors are to innovate in each specific technology area by looking at indicators such as the number of relevant patents, technology-specific export portions or production statistics, market share, or the number of relevant start-ups in each technology area[21].

The Current Policy Approach looks at whether the EU and its member states have specific visions and targets regarding a specific technology and how detailed these are. It builds upon institutional instruments – the tools the EU has at its disposal – and puts them into political context.

These sections also look at the extent to which there is policy coherence among member states or between the EU and individual member states.

The five new key enabling technology areas analyzed in this study were selected based on their dual-use or even general-purpose nature and whether they influence economic and military competitiveness. These technologies have also been chosen because they have become areas of geopolitical contention, which will be showcased in the next chapters.

While this study deals with each technology separately, it’s important to understand that these technologies in fact depend on each other and are often inter-related. For instance, AI systems can only become more effective as there are advances in the semiconductor industry, just as the increase in computation power and the huge and steady accumulation of data provide the necessary ingredients for more complex systems. The same interrelationship, for instance, can be drawn between cloud and edge infrastructures and advances that may be triggered by 5G technology. Therefore, even though these technologies are grouped, the mutual conditionality between them is important to keep in mind[22].

Increasing Europe’s capacity to act in the tech space is a long-term task. It will not be achieved in a mere year or two and it will involve, coordinating industrial commitments, securing access to skills and investments across the bloc, and formulating supportive policies at the member state level. Through the Digital Compass, the EU has just begun the process of overviewing competencies and responsibilities concerning new enabling technology areas on the EU level.[23] This exercise helps us to identify strengths and vulnerabilities in the digital and technological realm and to explore which measures we need to maintain or enhance to improve the EU’s capacity to act. Against this backdrop, foreign policy decision-makers can determine in which key enabling technology areas capacity building is most urgently needed and can have the greatest impact.

3.1 Artificial Intelligence

State of Play

Artificial intelligence (AI) is on track to penetrate all areas of life by enabling new forms of medical screening and patient treatment; self-driving vehicles; easier, more natural man-machine interfaces; more efficient logistics; better farming techniques and crop yields; and faster decision-making in everything from insurance, to banking, policing, and even national security. According to one study, global GDP will be 14 percent higher in 2030 due to efficiencies from using AI. This amount of GDP in absolute terms is more than the current GDP of China and India combined.[24]

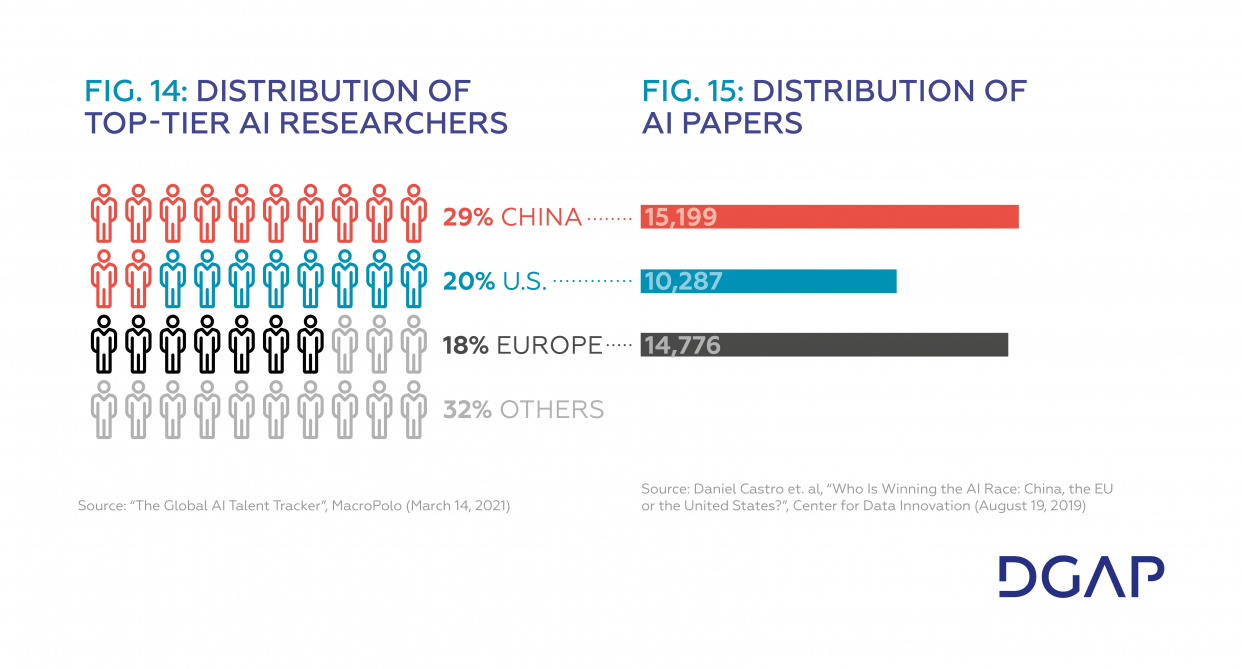

The transformational potential of AI has put heavy pressure on the EU, whose competitive industries – once defined by engineering precision – are increasingly defined by integrated systems powered by AI and data. As the Stakeholder Snapshot shows, there is a perception that two “AI superpowers” – the US and China – are battling it out for superiority in the AI space and leaving the EU behind.[25] But Europe is still in the game. It has an academic research base on par with both the US and China – reflected in the comparatively high number of AI research and conference papers. According to the Global AI Talent Tracker, 29 percent of the top-tier AI researchers currently come from China, 20 percent are from the US and 18 percent are from Europe.[26] That puts Europe only a small way behind the US. Europe has strengths in IoT and industrial data-based AI applications due to its globally respected manufacturing base as well as new research hubs like Baden-Württemberg’s Cyber Valley or the strong AI start-up scenes in cities such as Stockholm and Paris. However, there are three key sticking points that hinder Europe’s ambitions to catch-up in the global AI race.

The first of those sticking points is Europe’s inability to commercialize its AI developments. This is especially problematic because the private sector largely drives AI research demand and investment.[27] Europe trails behind the US and China in its number of registered AI-related patents. Only two European companies (Siemens and Philips) are among the global top ten AI patent-holding companies.[28] The EU has some clout in specific fields like patents for autonomous vehicles[29] but its broader inability to move from basic research to applied use cases capitalized by European industry is a central gap in European AI competitiveness. It has also left Europe without the kind of attractive commercial research ecosystems that exist in places like the US and Canada, which have drawn top European talent across the Atlantic.[30]

The second sticking point is lack of access to venture capital and limited prospects for scaling-up. In 2018, Europe (UK included) was second only to the US in terms of the number of AI start-ups, accounting for 22 percent of the overall number of AI startups on the global market.[31] However, only six of those EU-based start-ups are among the world’s top 100.[32] The COVID-19 crisis has created an influx of capital into Europe’s AI start-up scene as investors and governments ploughed money into specific areas like AI health applications. However, it remains to be seen whether this capital will continue to be deployed for future funding rounds or to build a broader AI tech start-up scene in Europe.

Finally, there is the question of data usage. Data is key to AI systems, since algorithms need to be trained how to operate by consuming and learning from data sets. The size and quality of data sets on which an AI application has been trained therefore directly impact its real-world utility.[33] The EU’s strong data protection regulation, which makes it a global leader in some settings, makes it difficult to obtain personal data sets from which AI applications can be trained. Whereas in China extensive data sets of faces and population movements, can be developed with very few restrictions and be actively pursued by the government, itself.[34]

European lawmakers need to find ways to harness data for AI while preserving its strong track record and reputation on data protection. The EU is now taking its first steps in this direction by implementing a flexible pilot for open access to research data in the Horizon Europe program. As part of that program, efforts are underway to create clear guidelines for anonymization that would allow Europe to take advantage of the continent’s high-quality pools of health data.[35] However, leveraging these strengths against the backdrop of the EU’s diminishing competitiveness in AI will prove a major mid-term challenge, especially given that reforms could take years to materialize.

Current Policy Approach

During the European Commission’s Jean-Claude Juncker years (2014-2019), the EU began to sketch out a strategic framework for its approach to AI[36] that included investing €20 billion per year in AI from 2020 onwards. [37] A High-Level Group on Artificial Intelligence (AI HLEG) was also launched, consisting of representatives from politics, industry, the research community, and civil society who together laid out seven guiding principles for ethical and trustworthy AI.[38]

When Ursula Von der Leyen became European Commission president, she set the EU’s sights on delivering a regulatory proposal on “trustworthy AI”.[39] The term basically refers to the notion that AI will be used under the conditions of strong data protection and limit the application of AI for rightful purposes according to the European values of democracy and human dignity. The EU’s February 2020 AI White Paper provides some guiding principles and some practical measures towards achieving the “twin objectives” of simulating indigenous European AI innovation and addressing potential AI-associated risks.[40] The paper sets out the need for stricter regulation on the question of whether an AI system is deemed “high risk” based on assessment of a technology’s use and sector. In the first “use” criteria, examples include recruitment processes or remote biometric identification. The second criterion includes sectors characterized by a high-risk density.[41] As of writing this report, the European Commission is working to integrate this risk classification system into a legislative proposal for AI that will likely set the tone for global discourse on AI regulations and standards.

The European Commission has also recognized the importance of data for developing AI technologies. The EU’s Data Strategy has the stated aim of creating a single EU market for data, particularly in non-personal, industrial data areas.[42] The strategy outlines the goals for a Data Act with incentives for business-to-government and business-to-business data sharing, including potential legal obligations for sharing data in certain cases. The aim is to create nine sector-specific “Common European Data Spaces”, in which different stakeholders pool their data to develop new applications for AI. This act is at the heart of EU’s attempt to get data economies of scale that can help it develop its competitive edge when faced with the massive incumbent advantages held by American and Chinese tech.[43] In essence, the EU wants to combine its strong industrial base with digitalization. However, a key challenge will be to persuade the private and the public sector to share data. Here, incentives and the promise of data protection (e.g. via data anonymization) will likely have to form a part of the upcoming Data Act.

The COVID-19 crisis has acted as an impetus for increased innovation, adoption, and financing of AI.[44] The European Commission remains committed to its aim of attracting over €20 billion in investments into European AI by leveraging existing funding programs like the Digital Europe Program, Horizon Europe, and the European Structural and Investment Funds. The European Commission Next Generation EU fund also includes €150 billion for technology R&D and digitization. France’s 2018 AI for Humanity Strategy included a pledge of €1.5 billion by 2022, including €700 million for research. Based on its 2018 AI strategy, Germany approved a €3 billion investment in AI capabilities until 2025. It then increased the amount to €5 billion as part of its COVID-19 stimulus package. Many of these efforts are driven by large core member states – France and Germany in particular. As such, these policies exist on the national level and could be duplicated by other member states across the EU.

Despite a recognition that AI mastery pits Europe in direct competition with the United States and China, the EU’s approach does not adequately address some of the underlying geopolitical tensions. For example, the growing trend of digital authoritarianism and dual-use potential of AI systems remains largely unaddressed. Another area in which the EU’s White Paper on AI falls short is in addressing the competing interests between AI and data protection. There is no AI without data, and in the EU, available data is severely limited by GDPR. In sum, the European Commission has to address more strategically how it wants to keep up in the AI race while not compromising on data protection.

Recommendations

Europe needs to catch up to the US and China in the commercialization of its AI technologies and access to data sources. Research capabilities and talent in this area are strong but the EU has fallen far behind in translating its indigenous strengths into commercialized advantages that could strengthen Europe’s innovation industrial base. To do so, Europe should:

- Leverage AI norms, standards, and regulation to codify European values: The EU should work on its legal and ethical AI framework and take the issue of AI regulation, norms, and standards beyond its own continent. In order to fulfil its global AI ambitions, the EU should engage with like-minded states to solidify its global vision of how AI should be used. The EU should pursue the development of AI principles, norms and standardize multiple formats and organizations – the Council of Europe, OECD, G20, UNESCO, ITU and standard setting bodies[45] – to promote its “human-centered AI” approach internationally as a direct counter-narrative to authoritarian AI, which is now on the rise through enhanced COVID-19 driven surveillance and China’s increasingly strident efforts to export AI-powered facial/voice recognition technologies and predictive analytics in its partner countries. This should include some mention of the geopolitical dimension in the upcoming European Commission’s new AI legislative proposal.

- Create large-scale public data pools usable for both AI research and AI application: Many AI systems need data sets to be trained. And the higher quality the data is and the more of it that exists, the more effective and accurate AI applications can be. The benefits of this are most obvious for sectors like health care, where the use of AI can already save lives today. But data availability can help spur AI innovation in many areas. At a minimum, data sets involving personal data need to be anonymized in accordance with GDPR. But further guidance will also be needed to interpret vague regulations to ensure there are no roadblocks to AI adaptation and advancements. The EU and its member states should push towards a broad open-data mandate (based on successful open-access mandates) to unify currently siloed public data pools. Additionally, the EU needs to develop an approach to incentivize the creation of pools of industrial data as well.

- Accelerate adoption of AI-based processes in the public sector: The EU and its member states should leverage COVID-19 relief efforts to incentivize the adoption of AI in the public sector through procurement mandates, funding, and tax structures. The EU should also identify AI use cases that could have the biggest impact and actively seek out private partners to create them, emphasizing cooperation with SMEs and start-ups, to implement AI-based processes. This sets an example in AI adaptation, builds trust in AI, provides valuable first-hand knowledge about the use of AI to officials, and can help make public administration more efficient as well, directly connecting the EU and its people. Furthermore, it supports and nurtures the domestic tech ecosystem at the same time.

3.2 Cloud Computing

State of Play

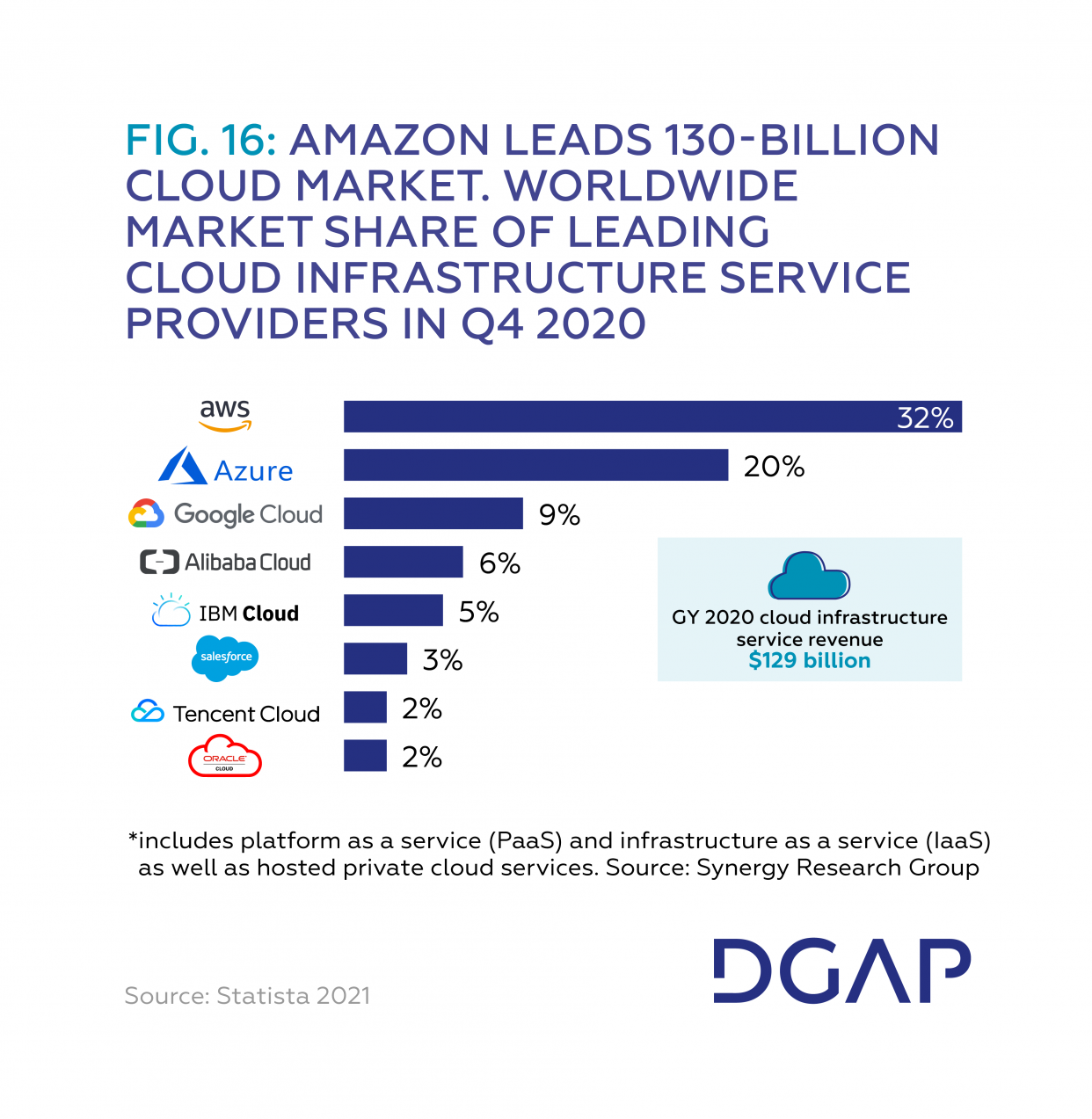

The dominance of US cloud service providers in Europe is a recognized fact. The Stakeholder Snapshot shows that over 76 percent of participants believe Europe is overly dependent on external actors and those actors are majority US-based (92.7 percent). With an accumulated 52 percent global market share,[46] US tech giants Amazon (Amazon Web Services) and Microsoft (Microsoft Azure) are leading the field.[47] Tencent and Alibaba from China are the only non-American enterprises in the top eight of the approximately €300 billion cloud computing market. However, these two companies and, to a lesser extent, China Telecom and Huawei, are gaining market share in the domestic Chinese and broader East Asian markets.

The cloud computing landscape favors large first movers that are able to develop path-dependent service relations with their users. Cloud users are locked into relationships with providers whose suite of offerings and terms of service regarding data interoperability and portability make it difficult to move to other providers. As noted in the stakeholder survey, first mover advantage is seen as both the most important and most difficult barrier holding back European competitiveness in key enabling technologies likes cloud computing. Developing a cloud infrastructure is also highly capital-intensive, requiring large networks of data centers and IT professionals maintaining operations. These high barriers to entry have been partially responsible for a relatively concentrated cloud market landscape in Europe. This is why Europe is highly dependent on US cloud providers such as Amazon, Microsoft, Google, and IBM. European players such as Deutsche Telekom, Orange, and OVHcloud are among the top five cloud providers in their respective countries but trail behind American companies, even in terms of usage across Europe.[48]

European attempts to gain a meaningful foothold in cloud computing have so far proven unsuccessful, even in the domestic market. France’s Andromède sovereign cloud project, launched in 2009 as a response to US cloud computing advances, poured over €200 million into two cloud providers only to see the initiative wound down in 2014 with little fanfare.[49] Projects like the European Alliance on Industrial Data and Cloud as well as GAIA-X, which are designed to create a cloud-based infrastructure on European standards, could face similar challenges.[50]

Current Policy Approach

The EU Data Strategy bluntly states that the EU needs to reduce its dependency on foreign cloud infrastructure and cloud providers. The EU has warned against the extraterritorial jurisdictional assertions in the US CLOUD Act and China’s Cybersecurity Law, which includes possible access provisions for data servers of American and Chinese servers, based in Europe.[51] This warning has been echoed by EU member states, particularly in Germany and France. Germany’s January 2021 Data Strategy also refers to GAIA-X as a means of emancipating Europe from locked-in cloud services (currently all American), which are seen as an immediate challenge given Europe’s accelerated adoption of cloud services for public administration, schooling, and healthcare during the COVID-19 crisis.

The European Commission has proposed investing up to €2 billion in high impact data spaces and federated cloud infrastructure with a potential additional €2-4 billion coming from member state and industry co-investment. All 27 member states have agreed to participate in a so-called €10 billion Alliance for Industrial Data and Cloud. This effort could eventually roll into an Important Project of Common European Interest (IPCEI), a special industrial policy vehicle aimed at an indigenous European federated cloud that can avoid being subject to state-aid restrictions. Some member states have already taken matters forward, for example with the GAIA-X project, which was initiated and developed by Germany and France and evolved into a legal non-profit organization in Brussels with the name GAIA-X AISBL. GAIA-X is a federated, pan-European cloud infrastructure project that aims to increase competition in the European cloud market and achieve “data sovereignty”.[52] GAIA-X is not an alternative European platform to rival the likes of Amazon Web Services or Microsoft Azure, but it should contain a common set of rules and standards for portability, interoperability, and interconnectivity of data. Most recently, the European Commission announced the target of deploying 10,000 secure edge computing nodes by 2030.[53]

Other attempts at building native European cloud services have proved difficult. The German attempt at establishing a tool for secure communication as an alternative to email called De-Mail was not successful, neither was the Franco-German initiative to create a European search engine called Quaero. Nonetheless, the GAIA-X project will be an important part of the new European cloud federation, which was announced by all 27 EU member states in a common declaration under the auspices of the German European Council Presidency in October 2020.[54] The declaration aims to politically underpin the native cloud concept from a multilateral perspective.

European cloud computing initiatives are still at an early stage. Even GAIA-X, for example, must still address fundamental questions about implementation, funding, and questions about whether anyone will use it. GAIA-X could also raise bureaucratic overhead with a potential abundance of technical specifications that could unintentionally strengthen the position of the leading American cloud providers if it turns out they already adhere to GAIA-X standards or only have to make very minor changes to do so. GAIA-X and efforts around it are a case study in Europe´s quest for enhancing its capacity to act in the technological realm. The fact that its focus is on a federated data infrastructure system rather than building a European company that could scale massively shows that the initiators are well aware of the difficulties of entering the cloud market. GAIA-X tries to circumvent the weaknesses of European cloud players and combine the EU’s regulatory and data protection strengths with potential new market entries.

Recommendations

Europe’s data is a valuable asset and the EU should make sure it is able to derive value from it rather than giving it freely to other global players by allowing it to be hosted by foreign companies. The EU can make an impact in the cloud computing space if it can:

- Learn from past mistakes and failed initiatives: Initiatives like De-Mail, Andromède, and Quaero failed to reach a wide audience. While the push for data sovereignty, currently spearheaded by the European Alliance for Industrial Data and Cloud and GAIA-X, is admirable, the initiatives can only be successful in the long-term if they can find users. And the most important factor in finding users is ensuring the cost is competitive and the services are reliable. Currently, European providers are not competitive in the market and the bureaucratic overhead (technical specifications and regulations that GAIA-X would enforce) is unlikely to change this for the better.

- Lower barriers for market entry: Discussion about cloud providers and infrastructure often centers on the big players already active in the market. The initiators of GAIA-X hope that European companies will benefit from the opportunity of this new federated cloud infrastructure project. But the EU should be careful that the project does not put more barriers in the way of large companies as well as SMEs and start-ups that may want to either use European cloud providers or develop technologies that use GAIA-X.

- Protect privacy as a matter of fundamental rights, not industrial policy: In its January 2021 Data Strategy, Germany cited the invalidation of the EU-US Privacy Shield as a reason Europe should decouple from US cloud services. Others have justified the need for air-gapped cloud infrastructure[55] on the basis of asymmetric extraterritorial access by US authorities in European cyber-space. The EU must enforce rules to protect its citizens’ data. It can do so by setting and enforcing clear rules and leveraging its regulatory power to ensure abidance. The EU should use the GDPR to impose fully compliant protections on cross-border data transfers as part of an enhanced EU-US Privacy Shield framework and seek to create a mutual lawful access framework through a possible e-evidence directive.

3.3 Semiconductors

State of Play

The semiconductor industry manufactures chips and microprocessors, which are the key enabling components for computer systems. Europe has never been a major player in this space and has lost even more ground in the sector over the last three decades. It is now highly dependent on American and Asian manufacturers for access to top-tier microchips.

In the case of semiconductors, the EU will find it very difficult to compete with incumbents. The three main steps in the production of microchips are design, manufacture, and then assembly, test, and packaging. Only a few companies such as Intel (US) or Samsung (South Korea) cover all three steps by themselves and even the ones that do, depend on suppliers to deliver crucial equipment for the manufacturing process. Even though the EU does contribute to this supply chain, it lacks a major player in either of these production steps.

Players from the US and East Asia dominate all stages of production in the high-end microchip market. Barriers to entry for cutting-edge products are very high, since cutting-edge chip production requires both extensive knowledge about processes as well as huge production facilities, which in turn depend on highly specialized personnel.

China’s biggest technological weakness lies in the semiconductors space. It has been trying to decrease its decades-long dependence by spending the equivalent of several billion euros to support its own domestic semiconductor industry and by engaging in industrial espionage to steal proprietary knowledge from others.[56] Nevertheless, the gap between Chinese firms and global top-tier enterprises remains significant, and homegrown Chinese chips are roughly five years behind their US counterparts. While China is capable of handling semiconductor manufacturing to some extent, it has so far struggled to acquire the knowledge base and IP to design its own chips. However, Taiwan is home to one of the leading semiconductor manufacturers (TSMC) – a capability China desperately seeks. If geopolitical tensions in the region escalate beyond aforementioned industrial espionage through to cyber-attacks, the world’s chip supply will be seriously impacted.

Europe has lost ground in top-tier semiconductor production. ARM Limited – a British company owned by the Japanese Softbank and one of the very few leading European players – is in the process of being sold to American microchip developer Nvidia, although the acquisition’s completion is in question. ARM’s chips are used in almost all smartphones worldwide and Apple recently switched from Intel based CPUs to ARM. ARM is a so-called fabless company, meaning it does not produce chips itself but instead commissions foundries to produce chips. This production generally occurs outside of Europe. Still, the importance of ARM’s intellectual property should not be underestimated. The British government is acutely aware of this and there is a significant chance that it – or another power – will block the sale to Nvidia. However, due to Brexit, the EU has already lost this expertise, which is a major blow to its capabilities in this area.

But European players do continue to lead in certain niche areas, such as automotive chip design, with stand-out companies including the Dutch-based NXP Semiconductors and the German-based Infineon. ASML, another Dutch production company, has developed the most advanced method of miniaturization of chip structures via its Extreme Ultra-Violet (EUV) lithography system and has been caught in the crosshairs of the US-China tech rivalry for its sales to Chinese companies.[57] Without this technology, high-end chip production is not possible. So the international spotlight on ASML is well justified. Despite these pockets of competitiveness, Europe is not likely to be able to catch up in large-scale state-of-the-art semiconductor manufacturing in the medium-term.[58] The participants of the Stakeholder Snapshot who rated semiconductors as the most difficult area to improve the EU’s capacity to act, also shared this assessment.

Instead of trying to close this gap, a promising approach – also pursued by China[59] – is to gain a foothold in emerging new microprocessor applications (e.g. special purpose microchips to train AI algorithms (AI chips) or for specific applications in the IoT and industry production). One particularly interesting new technology in this regard is RISC-V, a new and open chip standard that could wipe out the advantage of US players if it becomes competitive with current chip designs.[60] It is not surprising that China is currently very active in driving development of RISC-V. However, both US and European contributions to this new standard are significant and all players stand to benefit from an open microprocessor ecosystem.

Europe is well-positioned to leverage these new applications because of its strengths in existing niche markets, as well as its strong base in semiconductor research, led by the Inter-university Micro Electronics Center (IMEC) in Belgium, Laboratory of Electronics and Information Technology (LETI) in France, and Fraunhofer Institute in Germany.

Another option for Europe to reduce its supply chain dependencies is to ensure production capabilities within Europe, but not necessarily by European companies. To this end, the EU is weighing deals with high-end manufacturers like TSMC and Samsung.[61]

Current Policy Approach

Compared to the other technology areas, the semiconductor industry has been relatively low on the agenda of the EU institutions and member states. While the IPCEI Microelectronics focuses on five areas of chip technology (energy efficient chips, power semiconductors, sensors, advanced optical equipment, and compound materials) it is important to note that cutting-edge central processing units, as they are used in modern computers, are not among them. The need for novel legislation to regulate a completely new field, for instance, when it comes to AI, is very limited, and promoting European players in the high-end chip market would incur a huge cost.

Even though European Commission President Ursula von der Leyen claimed that the EU needs “mastery and ownership of key technologies in Europe [such as] critical chip technologies”,[62] the EU and German government have not been forthcoming with initiatives to realize these goals. However, since chip-making has evolved into a focal point of the US-Chinese tech competition, the EU has slowly started to become more active in this area. Twenty EU member states in December 2020 signed a declaration to launch a new European initiative aimed at making the EU competitive in high-end manufacturing and design.[63] However, the declaration came with no actionable plans to back up those goals.

Increasing the EU’s semiconductor capabilities is also a major aspect of the recently announced Digital Compass,[64] although the goals set out in this compass are rather vague and questionable from a technological perspective. For example, the Digital Compass 2030 mixes up total and top-tier semiconductor manufacturing and reduces the definition of what top-tier manufacturing processes actually are to mere descriptions of nanometer processes – lacking the level of accuracy necessary to be actionable.

While the EU is trying to play catch-up, the US is already formulating the next step in its journey to reduce supply chain dependencies on China by furthering decoupling the manufacturing process.[65] The EU will have to decide whether it wants to join the US effort or chart its own, independent path. The Stakeholder Snapshot shows that even with primarily European participants, there is only a very narrow majority in favor of charting an independent path.

Recommendations

Europe has lost ground in semiconductor capabilities in the last decade and it is not realistic to expect it to catch up in terms of cutting-edge design and manufacturing capabilities. Furthermore, the few remaining top-notch European chip companies will come under more pressure amid the US-Chinese tech competition. An EU semiconductor strategy dealing with these developments is needed and should include the following objectives:

- Preserve current chip production capabilities within Europe: To achieve this, the EU needs to protect essential companies in the semiconductor value chain, such as ASML, from foreign takeovers. Here, for instance, the EU should make use of its newly added instruments in the areas of foreign investment screening.

- Support the growth of local manufacturing capabilities: This includes creating manufacturing capabilities for foreign companies within Europe as well as helping private entities to enter the market in emerging new microprocessor applications. The EU should focus on special purpose microchips to train AI algorithms (AI chips) and leverage its existing strengths in IoT and the associated microchips IoT applications rely on.

- Promote open standards in chip design and architecture: Europe is lacking IP in this regard and lost its only major global player in chip design – ARM Limited. Open standards (e.g. RISC-V) can help level the playing field and reduce barriers for European companies to enter the market.

3.4 5G and Mobile Networks

State of Play

In 5G, Europe has good global positioning with two leading players – Ericsson (Sweden) and Nokia (Finland). These two companies compete directly with Chinese enterprises Huawei and ZTE (see fig. 6).[66] The US, in this case, does not have globally competitive industrial leaders.

The US may not have much skin in the game, but it would be premature to believe that 5G equipment leadership centered on two European companies and two Chinese companies will hold. Seoul-based Samsung, for example, is already challenging the 5G oligopoly with a massive expansion of 5G tech investment and growth of crucial 5G standard essential patents (SEPs).

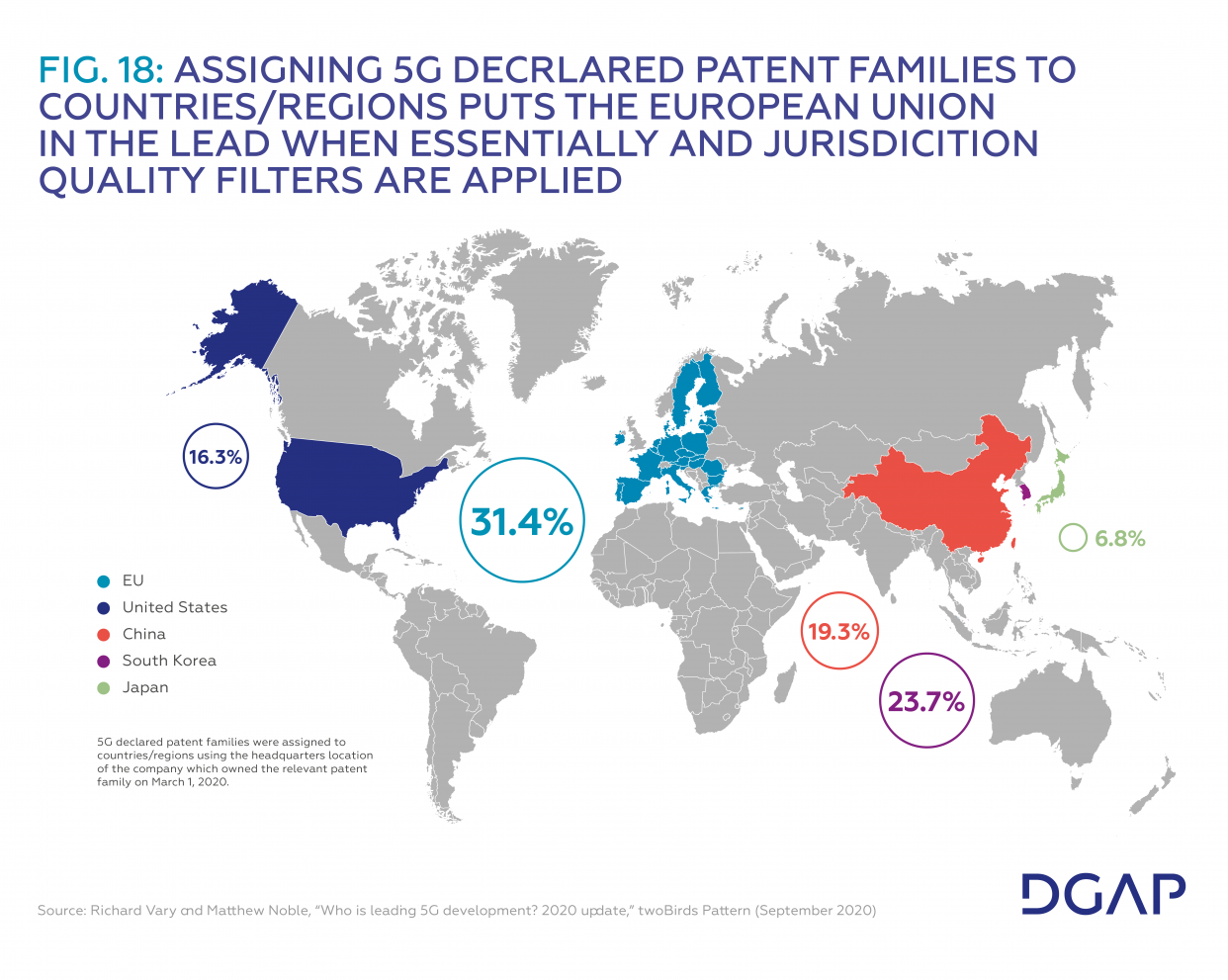

In the 5G context, control of standard essential patents is a direct measure of potential market power.[67] So much that companies often spoof control of standard essential patents through “over declaration”, to create the impression of market competitiveness. Clear estimations of SEP control are difficult to make because of its opacity. However, serious attempts to assess the SEP race adjusting for over-declaration show that the European Union is leading.

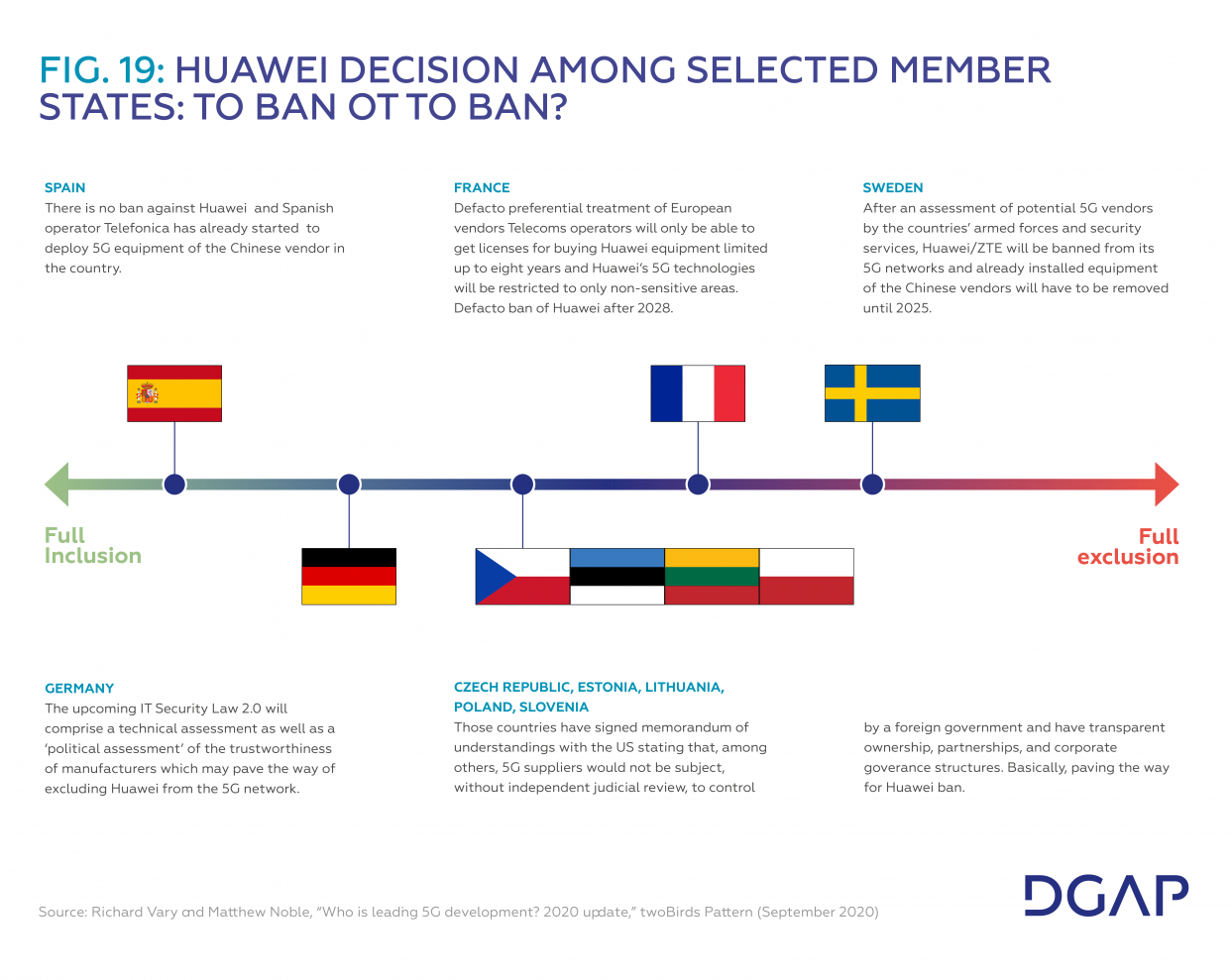

Still, Huawei’s pressure on Ericsson and Nokia is intense, and motivated by the singular goal of grabbing mobile infrastructure market share in Europe by using massive amounts of state aid, price dumping, and political strong-arming by the Chinese government.